Selling PDD Holdings (PDD): Upgrading My Portfolio While Staying Bullish on China

How disclosure quality, relative conviction, and risk diversification led me to rotate out of PDD and into UBER and CSU

A little over a year ago, I published Investing in China: Navigating Risks and Uncovering Opportunities, an article explaining why, despite all the complexity and headline risk, I believed China offered compelling opportunities for level-headed investors.

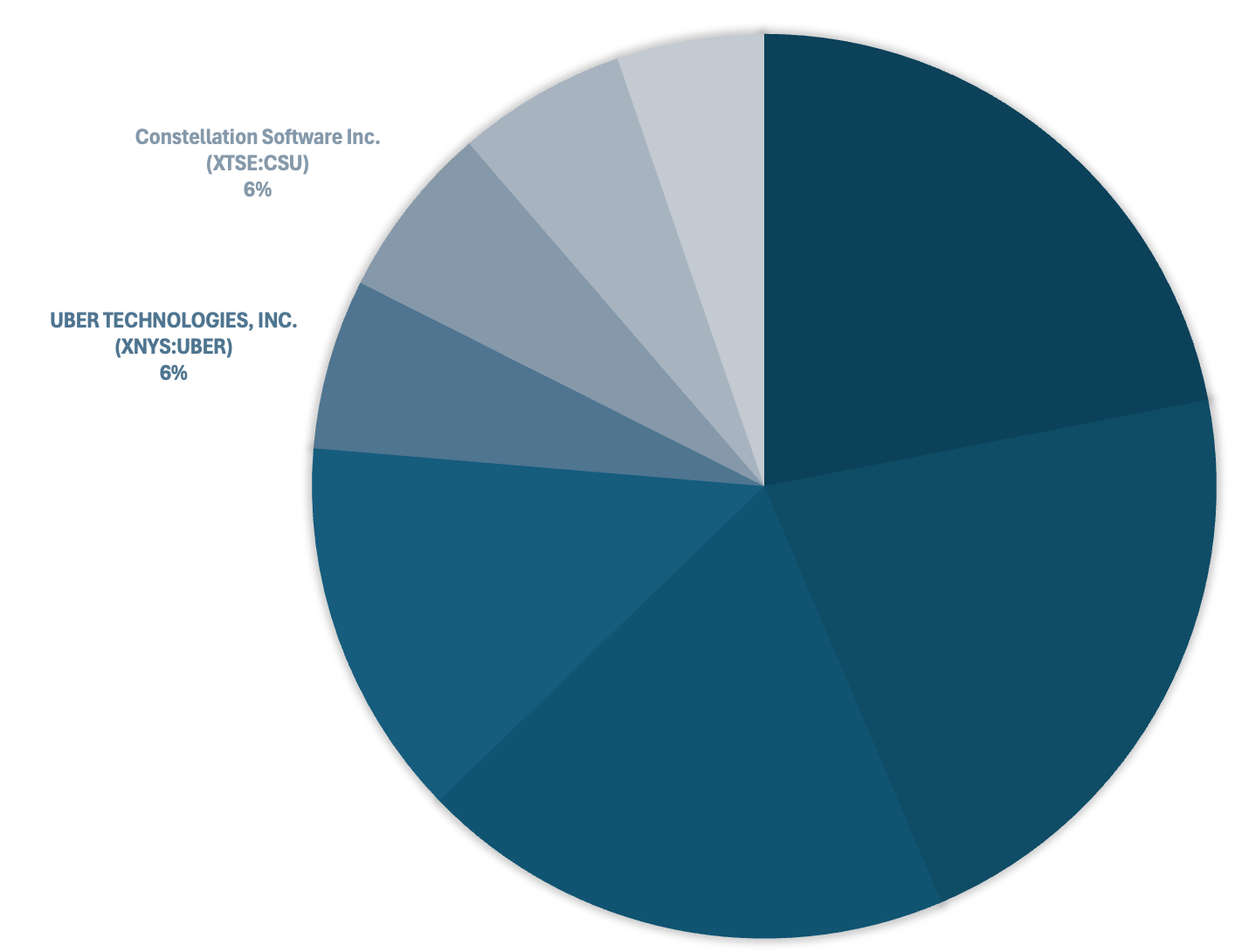

That article followed my first direct, stock-specific bet on China: initiating a position in PDD Holdings Inc. (PDD 0.00%↑, the parent company of Pinduoduo and Temu) in late August 2024 after its Q2 results and a sharp sell-off. Since then, a lot has happened in Chinese markets, and in my own thinking. Fast-forward to early November 2025: I’ve exited my PDD position at an average profit of about 27%, and I’ve redeployed the capital into two higher-conviction compounders: Uber Technologies (UBER 0.00%↑) and Constellation Software (CSU.TO).

This article is about why I made that shift, and why it doesn’t mean I’ve changed my mind about China.

One Year On: My China Thesis Still Stands

The core argument of my China piece was simple. China is a hyper-competitive, intensely dynamic market where creative destruction is the norm, in contrast to the West’s more entrenched platforms. Its regulatory regime is active, sometimes abrupt, and often driven by social and long-term economic objectives, even if that creates short-term uncertainty. Combined with deeply negative sentiment, this has left many high-quality Chinese businesses trading at significantly lower valuations than Western peers. The risks are real, and so are the rewards for level-headed investors willing to do the work, accept volatility, and think in decades rather than quarters. The question was never whether the risks exist; they clearly do. The real question is whether the potential rewards justify them. I still believe the answer can be yes.

So why sell PDD? Because a country-level thesis is not the same as company-level conviction. It’s consistent to be constructive on China as an economy and yet decide that a specific company no longer fits the way I want to express that view.

The Original PDD Holdings Thesis, and What Went Right

When I initiated my position in PDD in late August 2024, several elements lined up. The company had just reported Q2 2024 results. The market reaction was harsh: investors focused on near-term commentary and guidance, and the stock sold off by 40% from recent highs. At the same time, sentiment toward Chinese equities in general was deeply negative. That combination, a fundamentally strong business hit by a sharp, sentiment-driven sell-off, is exactly the sort of setup I look for as a value investor, and I quickly built PDD into a 10% position.

My thesis was straightforward: PDD was a structurally advantaged e-commerce platform, with deep penetration in rural and lower-tier markets in China and an innovative approach to social commerce and C2M (Consumer-to-Manufacturer) globally. I believed I was buying a great business at a substantial discount to its intrinsic value.

Price-wise, things unfolded reasonably well. After my initial purchase, the stock rallied strongly as sentiment improved, helped by government stimulus measures that lifted many domestic equities. Over my holding period, I ultimately exited at an average gain of around 27%.

Superficially, that’s a Graham-style textbook “successful” investment: buy when pessimism is high, hold as the business continues to execute, and sell after the market re-rates the stock upwards. Success on paper doesn’t automatically mean a position deserves to remain in the portfolio. Over time, my discomfort grew, not with the business performance per se, but with what I didn’t know.

Why I Chose to Exit PDD Holdings

The decision to sell was not based on a view that PDD’s business is broken or that its long-term prospects are poor. I expect the company to do well over time. Instead, the choice came down to three intertwined considerations: disclosure quality, portfolio construction, and relative conviction.

Disclosure Quality and Management Communication

As my holding period lengthened, I grew increasingly uneasy about how little I truly knew about the underlying drivers of PDD’s performance. On paper, the reporting is compliant; in practice, the disclosures are opaque, with limited granularity on segments and unit economics, making it hard for a long-term, fundamentals-focused investor to build a clear mental model of the business.

That was reinforced by management’s communication style. On earnings calls, direct questions often received high-level answers that largely repeated strategy and priorities rather than adding much beyond the press release and slide deck. I don’t expect management to reveal their playbook, but I do expect enough transparency to see how they measure success and what trade-offs they’re making.

With PDD, I increasingly felt I was flying with part of the instrument panel covered, acceptable for a small “toe-in-the-water” position, but not for a larger holding. By contrast, Uber’s financial statements, segment reporting, and commentary make it much easier to reconcile the story with the numbers. I don’t need perfection; I need enough clarity to underwrite a position with confidence, and over time PDD drifted below that bar.

Commerce Exposure and Portfolio Construction

The second factor was portfolio construction. PDD sits in a space where I already own two leading businesses I consider higher-conviction: Amazon.com (AMZN 0.00%↑) and MercadoLibre (MELI 0.00%↑).

Amazon is a global leader in commerce, cloud infrastructure, and digital ads, with a long track record of execution and transparent reporting around its key segments. MercadoLibre is Latin America’s dominant commerce and fintech platform, with strong network effects and a payments ecosystem that has become central to its region’s digital economy.

In different ways, all three businesses - Amazon, MercadoLibre, and PDD - operate as commerce aggregators. They differ geographically and strategically, but at the portfolio level they contribute to a similar thematic exposure: the economics of online platforms connecting buyers and sellers, a topic I explored in more depth in a prior article, Undervalued by Design: Amazon, Alphabet & the Economics of Aggregation.

Over time, I realized my allocation to this theme, and its risks, was higher than I wanted. If my portfolio is to remain concentrated in my very best ideas, I cannot justify multiple sizable positions that rhyme economically, especially when my conviction level differs meaningfully between them.

In that hierarchy of conviction, Amazon and MercadoLibre sit at the top. PDD, despite its impressive growth and innovation, slipped to a clear third.

Opportunity Cost and Relative Conviction

The final piece of the thesis is opportunity cost. By mid-2025, it became harder to justify keeping a position in PDD when I had structurally higher conviction in two other ideas: Uber and Constellation Software. Uber, which I’ve written about separately in Uber Technologies Inc. (UBER) Q3 2025 Results: The Global Royalty on Movement Shows Its Earnings Power, is evolving into an asset-light “royalty” on real-world movement and local commerce, and I find its valuation appealing relative to its cash-generation potential. In late October 2025, I also began building a position in Constellation Software during what is currently its largest draw-down, with the stock down 30%+ from its recent all-time high, an entry point I consider attractive for a proven compounder of this quality. From a portfolio construction perspective, Uber and Constellation help diversify risk across business models and end markets, and both are supported by disclosure practices that align with my analytical process. Faced with the choice between holding PDD, where my relative conviction had diminished, and reallocating into Uber and Constellation, where my conviction and perceived risk-adjusted returns were higher, the rational move was to redeploy the capital.

What This Move Doesn’t Mean About China

Exiting PDD does not represent a U-turn on my China thesis. It doesn’t mean I now think China is “uninvestable”. It doesn’t mean I’ve concluded Chinese companies cannot be good long-term holdings.

I expect that I will once again own Chinese companies in the future, potentially at greater size. When that happens, I want my capital in businesses where I can underwrite the long-term economics and governance with more confidence than I eventually could with PDD.

Process Takeaways: Conviction, Transparency, and Opportunity Cost

The PDD journey, from initial buy in August 2024 to exit in early November 2025, leaves me with a few process reminders that are worth writing down.

First, a macro thesis (“China will remain a critical growth engine for the world”) is not enough. For me, stock selection happens at the micro level: the specific business model, the quality of management, the governance structure, and the clarity of the information I receive as a minority shareholder.

Second, transparency acts as a kind of “meta-moat” around conviction. Two companies with similar underlying economics can feel very different to own if one communicates clearly and the other remains opaque. The stronger the business, the more painful it can be to admit that I don’t have the visibility I need. That admission is an essential part of disciplined investing.

Third, concentration is meaningful only if it is reserved for the ideas where my conviction is highest, not the businesses that fit a theme. The more I refine my process, the more willing I am to ask, “If I started with fresh capital today, would I still choose this stock over the alternatives?” If the answer is no, that’s a signal I need to pay attention to, even if the position has done well.

Finally, opportunity cost is not an academic concept. Every dollar tied up in PDD was a dollar that couldn’t be working for me in Uber, Constellation Software, or another high-conviction idea. Taking a reasonable profit and rotating into better-aligned opportunities is part of long-term thinking.

Final Thoughts

I continue to view China as one of the most important and fascinating arenas for level-headed investors, a place where risk and opportunity are tightly intertwined, and where understanding the local context is crucial. My October 2024 article on investing in China reflects my view of that landscape at a high level.

At the same time, my decision to exit PDD and redeploy capital into Uber and Constellation Software shows how I’m refining the way I choose to invest my capital: I’m being more demanding about the combination of business quality, governance, disclosure, and fit with my overall concentration.

My portfolio is not a museum of past theses; it is a living, evolving expression of where I believe risk and reward are most attractively aligned today. Right now, that means not owning PDD, and owning Uber and Constellation Software.

Couldn't agree more. Your analisys of market dynamics, especially in China, is spot on. It really takes a deep dive to understand the underlying currents. Reminds me of training a complex AI model, always needing to adapt and look beneath the surface.