Alphabet Inc. (Google) Q3 2025 Results: A Full-Stack Flywheel Meets Relentless Execution

Alphabet’s quarter, the CapEx super-cycle, and a still-mispriced leader

Alphabet Inc. (GOOGL 0.00%↑) posted Q3 2025 results (earnings release) on October 29, 2025; one of the strongest prints of the earnings season. Growth is broad-based, margins are expanding, cash generation is surging, and management is leaning in with record CapEx.

“This was a terrific quarter for Alphabet, driven by double-digit growth across every major part of our business. We are seeing AI now driving real business results across the company. We delivered our first-ever $100 billion quarter.”

— Sundar Pichai, CEO, Alphabet & Google

This quarter lands after a long stretch (2023 through early-2025) when headlines and investors doubted Google’s AI position, first after Bard’s botched debut wiped roughly $100 billion of stock market value in a day, then as Microsoft’s OpenAI bet seemed to widen the gap and Alphabet’s own CapEx plans stirred margin fears. I took the other side of that trade: I stayed bullish for years and kept adding on stock price’s weakness, arguing the stock didn’t reflect the fundamentals. I laid out that thesis in late-December 2024 - see my earlier post here.

For a flavor of the period’s skepticism, see the Bard error and selloff (Feb 2023), the cloud/AI comparison to Microsoft (Oct 2023), renewed margin fears as AI spend accelerated (Jul 2024), and the early-2025 sell-off tied to AI cost concerns.

The Full-Stack Advantage

During the Q3 earnings call, Pichai reiterated the company’s strategy succinctly:

“Our full-stack approach spans AI infrastructure, world-class research including models and tooling, and our products and platforms that bring AI to people everywhere.”

On infrastructure, Google is scaling both NVIDIA GPUs and its own TPUs, “Our highly sought-after TPU portfolio is led by our 7th-generation TPU, Ironwood, which will be generally available soon”. On AI models and tooling, Gemini usage is exploding: “Gemini now processes 7 billion tokens per minute via direct API used by our customers. The Gemini app now has over 650 million monthly active users, and queries increased by 3x from Q2”. And distribution is broadening via products people already use - Search, YouTube, Android, and subscriptions, where Google has “crossed 300 million paid subscriptions led by growth in Google One and YouTube Premium”.

The research engine is still firing. Pichai highlighted a quantum breakthrough and teased the AI roadmap: “We are looking forward to the release of Gemini 3 later this year”. Meanwhile, token volume across Google surfaces has gone parabolic: from 980 trillion monthly tokens in July to over 1.3 quadrillion now, part of “more than 20x growth in a year”. Just as important as the sheer volume is the span of sources: those tokens arise from a mosaic of real-world interactions - search intent, YouTube viewing, Maps routing, Android usage, continuously coursing through Google’s infrastructure.

Services: Search, YouTube & Subscriptions Show Broad-Based Strength

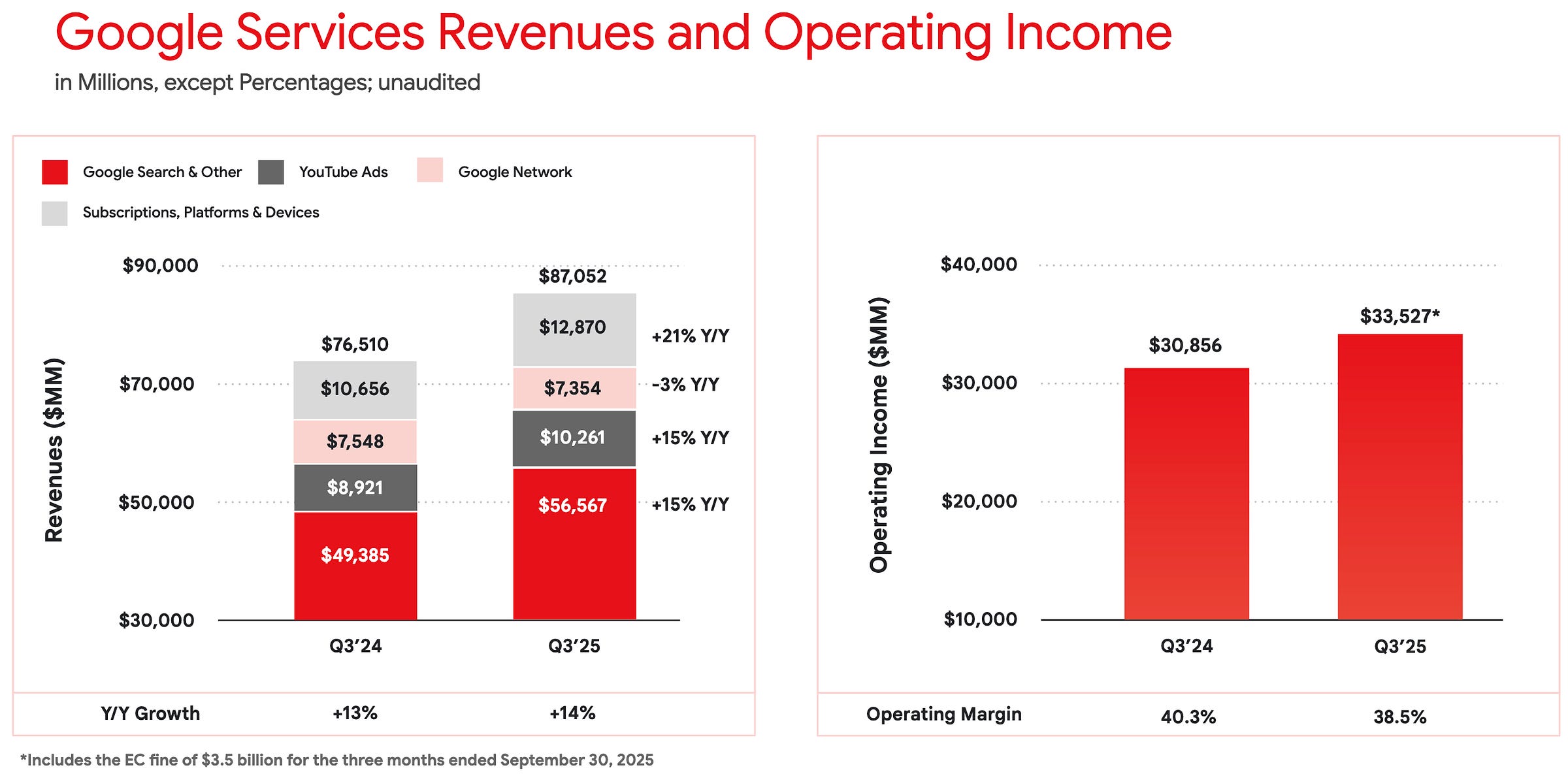

Google Services revenue reached $87.1 billion, +14% YoY, an acceleration of 1% versus the prior year:

Search & Other rose 15% to $56.6 billion, with retail and financial services the largest contributors and health care also adding to growth - and the drivers point to a healthy, expanding core, not erosion to competing AI chatbots.

YouTube advertising increased 15% to $10.3 billion, driven primarily by direct response.

Subscriptions, Platforms & Devices grew 21% to $12.9 billion on strong momentum in YouTube and Google One.

Services operating income was $33.5 billion (+9% YoY) with a 38.5% margin, both dampened by the European Commission (EC) fine; excluding the $3.5 billion EC charge booked in Services, operating income would have been $37 billion and operating margin 42.5%, a +2.2% expansion vs. 40.3% a year ago. These regulatory fines are episodic and largely one-off; for Google (and Big Tech generally) they’ve become a recurring cost of scale, more a periodic “tax on dominance” than a structural impairment to the business model.

The biggest strategic shift in Services is AI-native search - CBO Philipp Schindler captured the moment, “AI is driving an expansionary moment and transforming how people use Google Search”:

AI Overviews have now scaled “to over 2 billion users”, and crucially, “overall we see the monetization at approximately the same rate”. The near-identical phrasing for two quarters implies ad load in AI responses hasn’t materially increased yet. Even so, sheer usage growth (billions of incremental queries at current monetization levels) is driving revenue while Google continues to refine ad formats and density.

AI Mode has been rolled out globally across 40 languages and is gaining traction, with “over 75 million daily active users” in the U.S., “strong and consistent week-over-week growth”, and queries doubling over the quarter. In the 10-Q filing, Alphabet attributes the 15% YoY jump of Search to “increases in search queries resulting from growth in user adoption and usage on mobile devices; growth in advertiser spending; and improvements we have made in ad formats and delivery”.

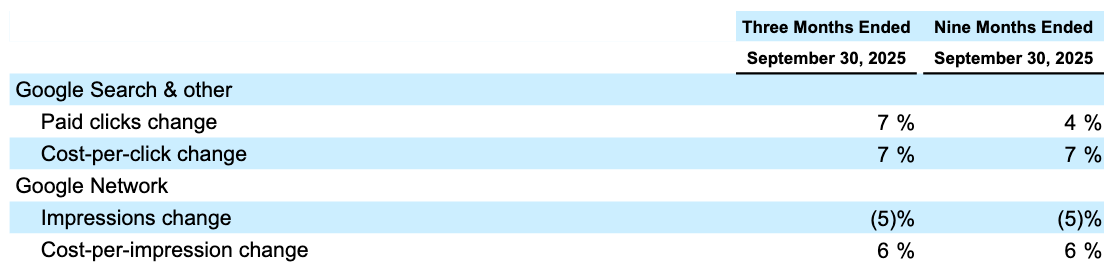

Monetization moved in the right direction on both volume and pricing, with paid clicks +7% YoY and cost-per-click (CPC) +7% YoY, evidence that the ad machine continues to calibrate around these new surfaces. The data supports my view that fears of Search losing ground to AI chatbots were overstated.

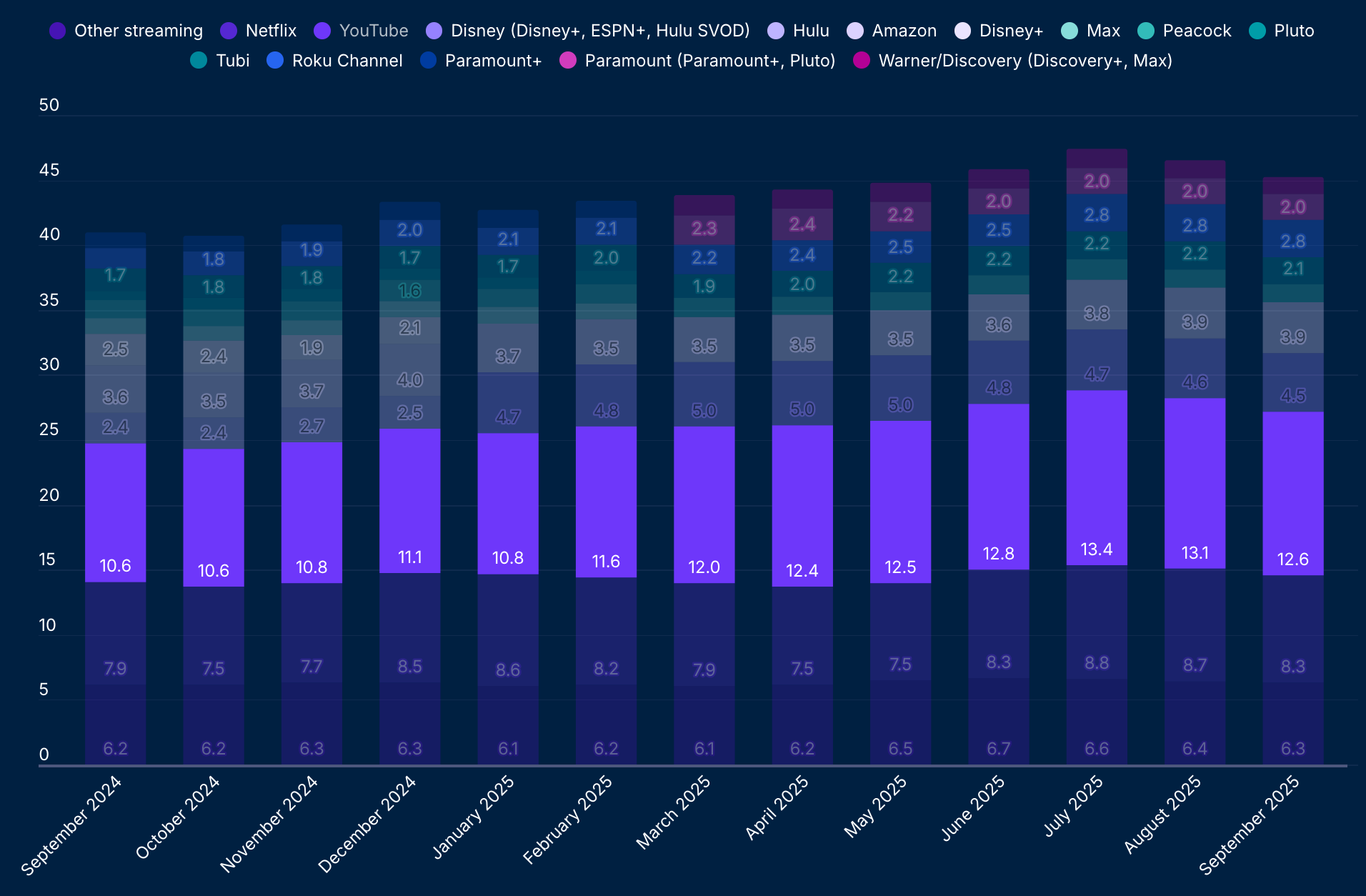

YouTube remains a twin-engine model, ads plus subscriptions, inside a healthy creator flywheel. In the living room, YouTube has been #1 in U.S. streaming watch time for over two years, and Shorts in the U.S. now earn more revenue per watch hour than traditional in-stream.

On ad innovation, Demand Gen improvements drove 40%+ increases in conversion value for target-based bidding, and interactive direct-response ad formats in the living room have surpassed a $1 billion annual run rate. Subscriptions (Music, Premium, and YouTube TV) continue to rise, with Schindler noting that a paying user often “generates a meaningful higher gross profit” versus ad-supported alone.

Cloud: Scale, Mix, and Margin

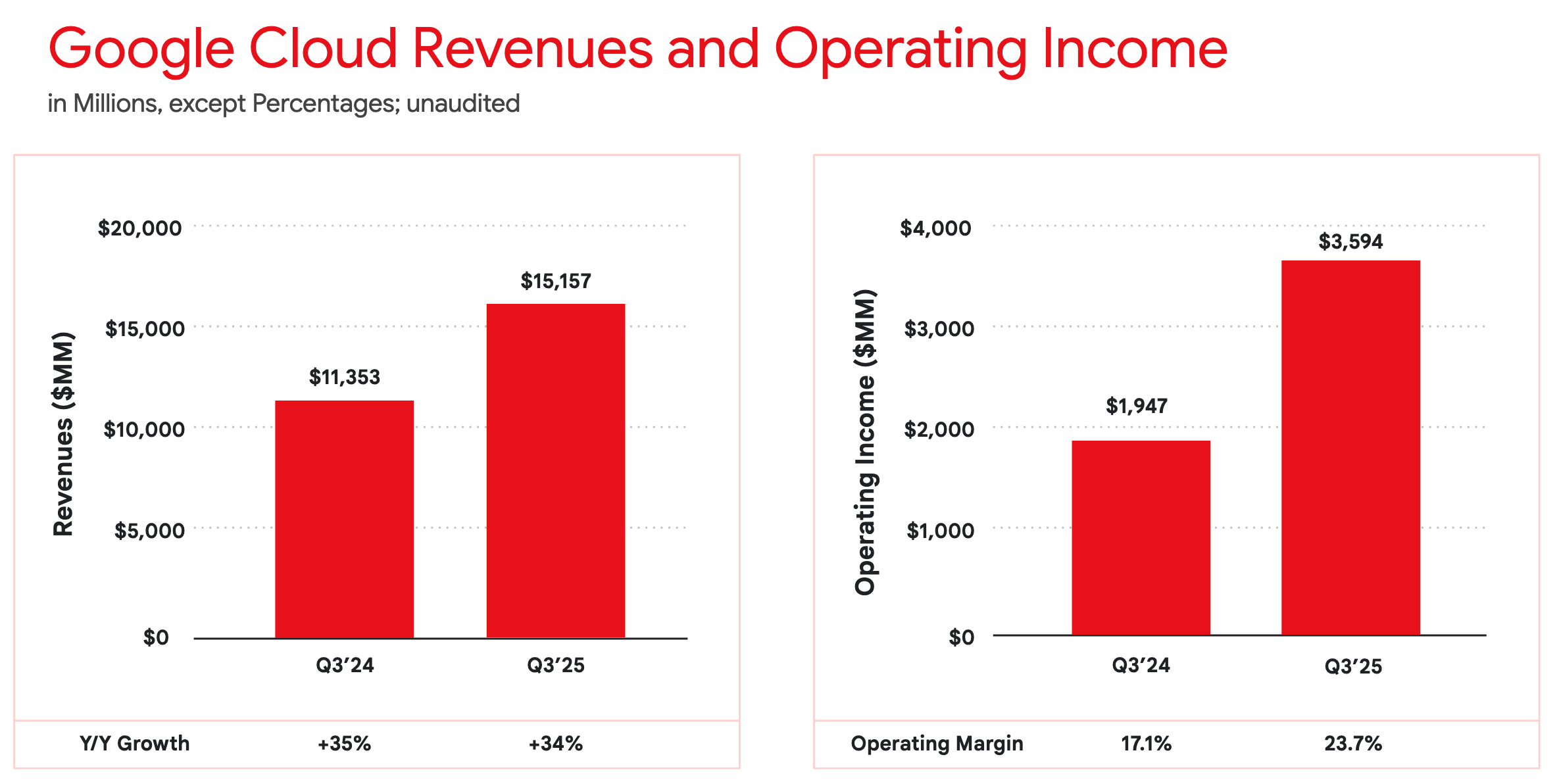

Google Cloud revenue grew 34% YoY to $15.2 billion. Enterprise AI products are now “generating billions in quarterly revenue” and pulling through both infrastructure (TPUs/GPUs) and solutions (Gemini 2.5 and peers). Operating income rose 84.6% YoY to $3.6 billion, lifting operating margin from 17.1% to 23.7% despite heavier depreciation and energy costs. More revealing, though, is what’s behind that margin expansion: Google’s structural cost advantage from TPUs, its custom AI chips. By leaning on in-house TPUs, Google sidesteps much of that “GPU tax” and enjoys a superior tokens-per-dollar1 profile. It’s not merely a cheaper chip, it’s a lower-cost stack end to end.

Demand is strengthening on three fronts. First, “the number of new GCP customers increased by nearly 34% year over year”. Second, deal size is inflecting: “We have signed more deals over $1 billion through Q3 this year than we did in the previous 2 years combined”. Third, adoption is deepening: “Over 70% of existing Google Cloud customers use our AI products”. AI monetization is scaling: “revenue from products built on our generative AI models grew more than 200% year-over-year” and nearly 150 customers processed ~1 trillion tokens each over the past 12 months.

Massive Backlog, Usage-Driven Revenue

Revenue backlog sits at $155 billion, up 46% sequentially and 82% YoY - roughly two and a half years of revenue at today’s run-rate. The 10-Q adds more color: remaining performance obligations (RPO) were $157.7 billion, “primarily related to Google Cloud”, with over 55% of that set to convert to revenue within 24 months. These figures reflect multi-year enterprise commitments from customers that view Google Cloud’s infrastructure as mission-critical. The filing also clarifies that RPO includes deferred revenue and amounts not yet invoiced but excludes cancellable arrangements and those with an original term of one year or less, and stresses that recognition depends both on Google’s ability to deliver and “when our customers utilize services”. In other words, the headline backlog is real demand, but the pace at which it turns into revenue is usage-driven.

On customer demand signals, Pichai highlighted a fresh Anthropic expansion: the AI lab “plans to access up to 1 million TPUs”. My take is that this deal is a powerful indicator of demand, but I’m cautious about assuming it fully materializes on the timetable or at the implied utilization, as the conversion risk sits with Anthropic’s economics - the company has been heavily loss-making, burning an estimated $5.6 billion in 2024 with an expected $3 billion burn in 2025, despite rapidly rising revenue. Accordingly, I discount this deal in my assessment of backlog, and my investment thesis does not rely on this AI lab deal materializing.

AI Inside: Real Productivity Gains

Alphabet isn’t just selling AI, it’s using it to run leaner and faster. On the call, Schindler said:

“Our sales teams use Gemini enriched with ads knowledge to streamline customer interactions. This increased productivity by over 10% led to hundreds of millions in incremental revenue and frees up sellers to engage with more customers at a deeper, more strategic level.”

He added that in Customer Support, “Gemini-powered solutions have managed over 40 million customer sessions so far this year and resolved hundreds of thousands of customer inquiries”. CFO Anat Ashkenazi underscored the broader impact, noting that “now nearly half of all code [is] generated by AI” as part of ongoing efficiency work across the company. You can see the financial echo of those gains in management’s framing that margins benefited from “continued efficiencies in the expense base” (excluding the EC fine).

Outlook: Q4 2025 and 2026

Ashkenazi struck a constructive tone for Q4: “At the current spot rates, we could see an FX tailwind to our revenues in Q4. However, the volatility in exchange rates could affect the impact of FX on Q4 revenues”. Advertising comps will be tougher, “as year-over-year comparisons in advertising will be negatively impacted by the strong spend on U.S. elections in the fourth quarter of 2024, particularly on YouTube”. Cloud remains the engine, with “demand for our products” still high and a “$49 billion sequential increase in Cloud backlog in Q3”. To meet AI infrastructure needs, Alphabet “now expect[s] CapEx to be in the range of $91 billion to $93 billion in 2025”, and “we expect the growth rate in depreciation to accelerate slightly in Q4” She also noted that “sales and marketing expenses [will] be more heavily weighted to the end of the year”.

Looking to 2026, Ashkenazi guided to capacity-first execution: “[…] while we have been working hard to increase capacity and have improved the pace of server deployments and data center construction, we still expect to remain in a tight demand-supply environment in Q4 and 2026”, and “we expect a significant increase in CapEx” next year, with specifics on the next earnings call. The message is clear: near-term depreciation and operating cost pressure are the toll for extending the lead in cloud and AI, backed by visible demand. Depreciation rose 41% YoY in Q3 and, with CapEx roughly doubling, is poised to accelerate through 2026. Excluding the EC fine, operating margin came in at 33.9%, a shade below the 34%+ of the prior two quarters.

Valuation: Pricing the Full-Stack Compounding Engine

In my earlier article, Undervalued by Design: Amazon, Alphabet & the Economics of Aggregation, I argued that market structure systematically underprices aggregators like Alphabet. Since then, the multiple has drifted up - from 20x P/OCF in October 2024 to about 22.5x P/OCF today.

I value Alphabet on operating cash flow (OCF), not free cash flow or net income, because the company is in a CapEx super-cycle (front-loading AI and cloud infrastructure across servers, TPUs/GPUs, and data centers), which suppresses near-term FCF and net income is distorted by volatile Other Income and large non-cash D&A. OCF best reflects the business’s true cash generation in this phase.

Trailing twelve months (TTM) OCF per share rose from $8.46 (Q3 2024) to $12.41 (latest), +46.62%, while revenue per share climbed to $31.59 (+15.4% YoY). Over the same span, the stock advanced to $281, up ~65% since October 2024. The move from 20x to 22.5x P/OCF wasn’t multiple expansion alone; it came with meaningful OCF/share acceleration as Google widened its AI lead and the CapEx cycle began to monetize.

Now, what does that cash engine imply five years out? Using TTM OCF of $151.4 billion as of September 30, 2025 as a base, assuming a conservative growth rate of 12% annually for five years gets to $266.86 billion. Let share count shrink 2% a year (the share count net reduction was -2.31% yearly for the past 5 years) to 11 billion shares on buybacks. Hold the exit P/OCF at 22x and you get a future stock price of $533 ($266.86 billion / 11 billion shares x 22). Add dividends ($0.21 quarterly payout2 is $0.84/year or $4.20 over five years) and total future value is $536/share. Discounted back five years at 10%, that yields a today fair value of $333/share, a 18% discount to today’s price of $281 and a 5-year compounded annual growth rate (CAGR) of 13.8%, above my 10% hurdle rate.

22.5x P/OCF looks full versus the 18x 10-year average, but the trajectory matters. Services is sturdy; excluding EC fine, margins are rising, and AI-native upgrades in Search/YouTube/Workspace should lift revenue and unit economics as ad formats mature. Cloud at 23.7% margin is early; as on-prem shifts to cloud and mix tilts to enterprise AI infra/solutions, each margin point disproportionately boosts consolidated profit. If AWS’s 30-35% is a guide, 30%+ for GCP is a reasonable long-run target. CapEx is dampening FCF now but is rational if ROIC stays high; backlog, deal mix, and surging AI token volumes support that.

Risks remain: execution must match CapEx intensity; supply constraints could bite; and regulatory overhangs, from fines to remedies, can pressure margins and strategic optionality. Competitive pressure, particularly from Azure’s deep enterprise embedding, isn’t going away.

Net-net, despite the stock’s run, the market still isn’t fully pricing the compounding from Alphabet’s full-stack AI position, cloud margin runway, and resilient Services economics. On my scorecard, Alphabet remains undervalued and it continues to be a core holding in my portfolio.

Final Thoughts

Alphabet just delivered a quarter that reconciles the narrative with the numbers. Search, YouTube, and Subscriptions are compounding; Cloud is scaling with improving unit economics; and AI is no longer a press release, it’s a P&L driver. The company is spending aggressively on infrastructure, but the return signals are already visible in Cloud backlog, rising Cloud margins, and the adoption of AI-native surfaces across the core products.

I anchor on operating cash flow. Despite the multiple drifting from 20x to 22.5x P/OCF, the business has outgrown the multiple: OCF/share rose 47% over the past year, and a five-year build from today’s OCF, conservative share count shrink, and a steady exit multiple still points above today’s price even after a fresh rally. Add the optionality (Waymo, AI agents, and other bets), and the thesis remains simple: the market continues to underprice a full-stack AI platform with durable distribution and accelerating monetization.

Tokens-per-dollar (TPD): A cost-efficiency metric; the number of model tokens you can process or generate per $1 USD of total compute spend (hardware, power, depreciation, and ops at typical utilization). Higher TPD = lower cost per token.

The dividend math lines up with Alphabet’s recent actions: Board declared $0.21 for the December 15, 2025 payment; dividend program initiated at $0.20 in 2024 and lifted to $0.21 in 2025.

Nice paper, as usual.