Parallel Plays: Where My Portfolio and Bill Ackman's Pershing Square Converge and Diverge

Why I built stakes in Alphabet, Amazon, Brookfield, and Uber; sometimes ahead of Ackman, and where our paths split

In my deep dive on Pershing Square Holdings, I explored Bill Ackman’s investing philosophy, track record, and the theses behind each of his current holdings. In this follow-up, I take a more personal angle: how my own portfolio construction and investment decisions compare to Ackman’s.

While we share a belief in concentration, patience, and conviction, our portfolios reflect different circles of competence and growth expectations. In some cases, I built positions months before Pershing Square, often at similar or better prices. In others, I’ve stayed on the sidelines, either waiting for better valuations or avoiding areas outside my expertise.

Converging on Conviction

Running a concentrated portfolio of 8 holdings, I’ve always resonated with Ackman’s focused style. Like Pershing Square, I believe a handful of well-researched bets can outperform a large basket of just okay indifferent holdings.

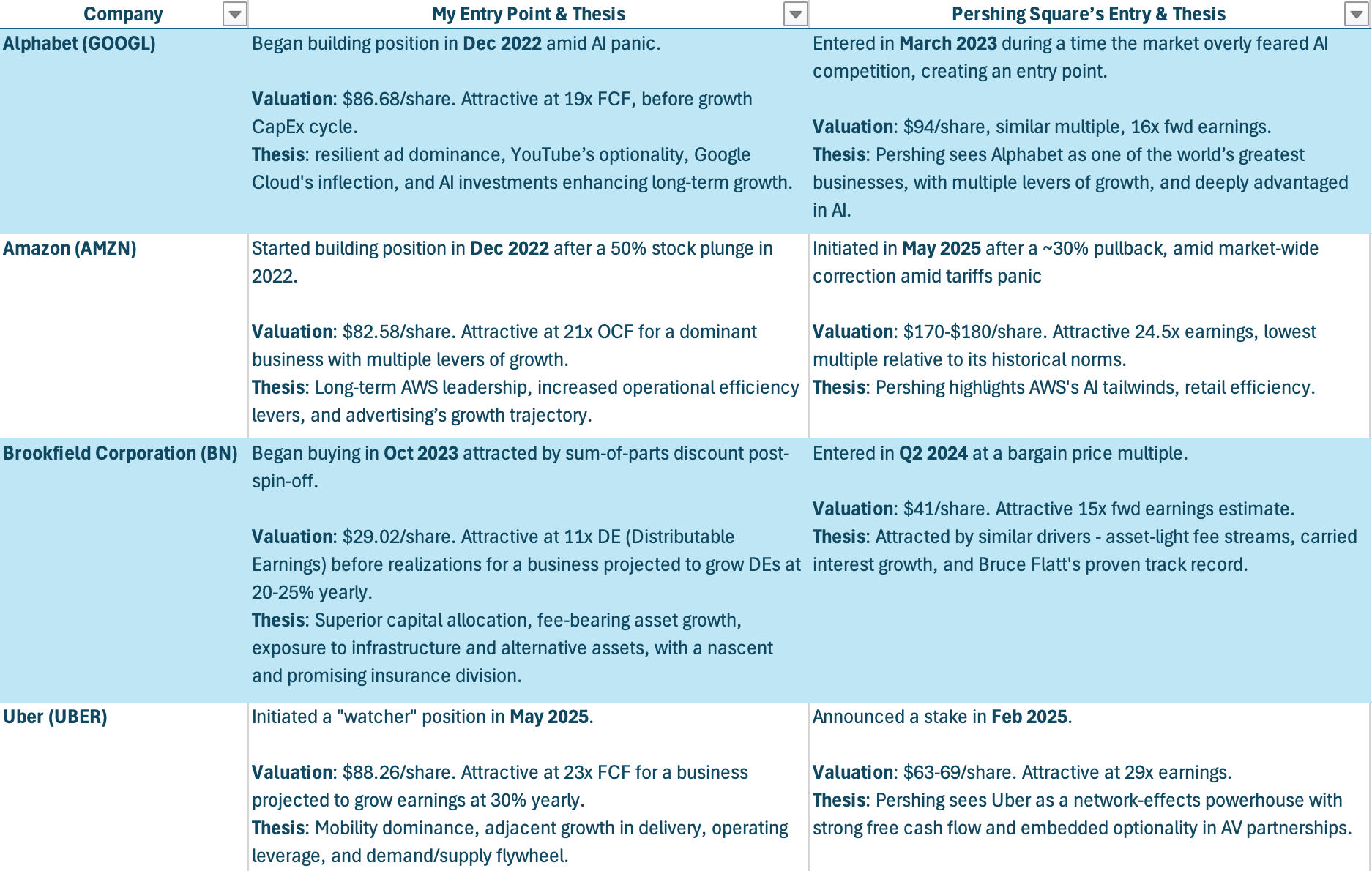

What’s validating is that some of my stock picks overlap with Pershing Square’s, not just in name, but often in timing and thesis. Below, I break down four shared positions and how our independent analyses led us to similar conclusions.

Alphabet & Amazon: Buying the Dip on Mega-Cap Titans

I started building positions in Alphabet (GOOGL 0.00%↑) and Amazon.com (AMZN 0.00%↑) in late 2022, when both stocks were under heavy pressure – Alphabet over AI fears and Amazon over cost structure concerns. These were classic contrarian buys, the kind Ackman also loves. Pershing Square initiated its Alphabet stake in March 2023 at similarly attractive valuations, while they waited until April 2025 to buy Amazon, taking advantage of a pullback that brought the stock back to 24.5x earnings, its cheapest level since the Great Recession. I added more during the April 2025 selloff, aligning my cost basis closely with Pershing’s.

In both cases, we independently capitalized on market overreactions to short-term noise, confident in the long-term dominance of these businesses. Pershing called Alphabet “one of the greatest businesses” with enduring moats and Amazon a “fantastic franchise” temporarily on sale – sentiments that echo my own thesis.

Brookfield: Spotting Value Early

I began buying Brookfield Corporation (BN 0.00%↑) in October 2023, convinced the market was overlooking its transformation after the asset-management spin-off and undervaluing its portfolio of premier assets. By the time Pershing Square disclosed its stake in mid-2024, I had already increased my holdings at cheaper valuations.

Pershing later made Brookfield a top-three position, validating my conviction. Ackman’s thesis mirrored mine: Brookfield trades at a steep discount to intrinsic value despite world-class infrastructure, property, renewable energy assets, a promising new insurance division, and rapidly growing distributable earnings. This was a case where patient investors saw through short-term market noise, like interest rate worries, to the underlying long-term opportunity.

Uber: Pershing’s Conviction Accelerated Mine

Uber Technologies (UBER 0.00%↑) had been on my watchlist since it started generating free cash flow in Q1 2023, but I hesitated to act. That changed in February 2025, when Pershing Square revealed a $2.3 billion stake, calling Uber an “extremely rare” opportunity available “at a massive discount”. I revisited my research and agreed: Uber’s demand-supply flywheel, improving unit economics, and platform scale were being undervalued due to autonomous vehicle (AV) fears.

In May 2025, I opened a starter position (<3% of my portfolio) with plans to build it over time. While my timing followed Pershing’s disclosure and my cost basis is higher, Ackman’s conviction validated my thesis. Like Pershing, I believe Uber is evolving from an unprofitable disruptor into a cash-generating, moat-worthy platform, and we both acted while skepticism still lingered.

Like Pershing Square, I run a focused portfolio where conviction drives allocation. Ackman typically holds 10-15 businesses, with his top five making up over 60% of the fund. Similarly, my top four holdings – Amazon, Brookfield Corporation, Alphabet, and MercadoLibre – account for 72% of my portfolio.

The rest is rounded out by niche or high-growth leaders, with Uber now joining the mix. Despite differences in sectors and geographies, the common thread is clear: I back market leaders with durable moats, strong management, and attractive valuations when I buy.

Where We Diverge

Where Ackman and I differ is in the types of opportunities we pursue. Pershing Square often embraces event-driven bets and complex restructurings where outcomes hinge on management execution or regulatory shifts. I prefer businesses with durable moats, straightforward models, and clear growth drivers.

I also avoid leverage and derivatives, which Pershing occasionally uses, and I lack the activist influence to drive corporate change. My portfolio includes smaller-cap and overseas holdings like Pinduoduo (PDD 0.00%↑) and Evolution AB (EVO.ST), whereas Pershing focuses mostly on large U.S. names.

Additionally, I disagree with Pershing’s decision to liquidate Netflix, which I’ve discussed in a previous post where I explored my reasons in more depth.

Final Takeaways

Bill Ackman and I share a conviction-driven, concentrated philosophy, but we express it differently. On some names, like Alphabet and Brookfield, we’ve reached similar conclusions, sometimes I even started my stakes before Pershing Square. On others, I’ve stayed disciplined, passing on areas outside my circle of competence or waiting for better valuations.

The takeway for level-headed investors is simple: conviction doesn’t mean convergence. Two investors can follow the same principles yet craft different portfolios. Pershing Square’s journey reaffirms what I strive to practice: invest in what you understand, buy at the right price, concentrate where conviction is highest, and tune out the noise. While our scale and influence differ vastly, the essence of how we seek alpha is much the same.

For a full breakdown of Pershing Square Holdings’ portfolio and investment theses, you can read my deep dive on Ackman’s portfolio.