Interest Rates: The Gravity of Stocks and Their Influence on the Economy

Understanding how interest rates shape markets and the economy: insights from the Fed, Buffett, and Munger

Introduction

Warren Buffett famously likened interest rates to gravity for stock markets, stating during the Berkshire Hathaway’s annual meeting in 2013:

“Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

This powerful analogy illustrates how interest rates impact stock prices and the broader economy. As interest rates fall, the return on safer assets like bonds declines, making stocks more attractive in comparison. This leads to higher valuations and increased capital flows into equities.

But to fully grasp the significance of Buffett's statement, it is crucial to understand what interest rates are, how they influence the economy, and their effect on key financial indicators like Treasury yields.

Who is the Fed?

The Federal Reserve (often called the Fed) is the central bank of the U.S., responsible for overseeing the nation’s monetary policy, regulating banks, and maintaining financial stability. It was established in 1913 to provide a safer and more flexible financial system. The Fed operates independently within the government but is subject to congressional oversight. The Fed has two primary mandates, known as the dual mandate:

Promote maximum employment: Ensure that as many people as possible have jobs without causing inflationary pressure.

Stabilize prices (control inflation): Keep inflation low and stable, aiming for a long-term inflation target of around 2%.

These mandates help the Fed manage the overall health and stability of the U.S. economy.

What Are Interest Rates?

Interest rates are the cost of borrowing money, typically expressed as a percentage. When you take out a loan, whether for a mortgage, a car, or a business investment, the lender charges interest as compensation for the risk of lending you the funds. The most influential interest rate in the U.S. economy is the federal funds rate, set by the Fed. This is the rate at which banks lend to each other overnight, and it serves as a benchmark for many other interest rates in the economy.

The Fed uses interest rates as a tool to influence economic activity. By adjusting the federal funds rate, the Fed aims to either stimulate or cool down the economy:

Lower interest rates: Encourage borrowing and spending, which can boost economic growth, but may also lead to inflation if demand outstrips supply.

Higher interest rates: Discourage borrowing and spending, which can slow inflation but also risks slowing economic growth.

How Interest Rates Influence the Economy

Interest rates are a key lever for controlling the economy. Here’s how changes in interest rates affect various aspects of economic activity:

Consumer spending and business investment: When rates are low, borrowing costs decrease. Consumers are more likely to finance big purchases like homes and cars, while businesses can borrow more cheaply to invest in expansion, acquisitions, or new products. Conversely, when rates rise, borrowing becomes more expensive, curbing both consumer spending and business investment.

Corporate borrowing: As interest rates decrease, companies can borrow at cheaper rates, which allows them to expand more aggressively. Lower financing costs can boost profitability, either through new investments or refinancing of existing debt at lower rates, enhancing their appeal to investors.

Employment: As businesses expand during periods of low interest rates, they tend to hire more workers, reducing unemployment. However, if rates are raised too quickly, businesses may cut back on hiring or even lay off workers, increasing unemployment.

Inflation: Lower interest rates can stimulate demand in the economy, but if demand grows too fast relative to supply, it can cause prices to rise, leading to inflation. The Federal Reserve raises rates to combat inflation by reducing demand, which slows price increases.

The Effect of Interest Rates on Treasury Yields

One of the most immediate effects of changes in the federal funds rate is seen in Treasury yields, which represent the return on U.S. government bonds. Treasury yields are a key benchmark for interest rates across the economy because they are considered risk-free, backed by the U.S. government.

When interest rates fall, Treasury yields also tend to decrease. This makes bonds less attractive to investors since the yield (or return) on newly issued bonds is lower. As a result, bondholders often shift their money into assets that are considered riskier like stocks, which helps drive up stock prices.

When interest rates rise, Treasury yields increase, making bonds more attractive relative to stocks. As bond yields rise, some investors sell stocks and move money into bonds for their higher and allegedly safer return.

Why Lower Interest Rates Lift Stocks

Lower federal fund rates tend to lift stocks because they reduce the cost of borrowing for companies and investors, which can lead to higher corporate profits and increased investment in the stock market. When the Fed cuts rates, companies can borrow more cheaply to fund growth initiatives, such as expanding operations, acquiring other companies, or buying back shares.

Additionally, lower rates decrease the return on assets considered safer like bonds, making stocks more attractive in comparison. As bond yields fall, investors often shift their capital into equities, driving up stock prices.

Furthermore, the intrinsic value of a company is fundamentally tied to the present value of its future cash flows. When interest rates are low, the discount rate used to calculate these cash flows falls, which makes the future earnings of a company more valuable in today’s terms. This directly pushes stock prices higher as investors are willing to pay more for a given level of earnings.

What Investment Legends Think of Interest Rates

Warren Buffett and Charlie Munger, two of the most respected voices in investing, have spoken about the importance of interest rates, including the federal funds rate, in determining asset prices and shaping investment decisions. Their views highlight how crucial these rates are to both the economy and the stock market.

Warren Buffett on Federal Fund Rates

Buffett has consistently emphasized that interest rates are one of the most critical factors in valuing investments. He has repeatedly made the analogy that interest rates act as gravity on financial markets. When interest rates are low, they reduce the discount rate applied to future cash flows, making stocks and other assets more attractive and inflating their prices. Conversely, when rates rise, the gravitational pull increases, putting downward pressure on asset prices. Buffett has remarked:

“The value of every financial asset, including stocks, bonds, or real estate, is influenced by interest rates. As interest rates rise, asset prices typically fall, and when interest rates fall, asset prices rise.”

Buffett famously said during an interview in 2017:

“The most important item over time in valuation is obviously interest rates. Low interest rates make any stream of earnings from investments worth more money. Any investment is worth all the cash you're going to get out between now and Judgment Day, discounted back. Well, the discounting back is affected by which interest rates you use.”

He said that the extraordinary market valuations of recent years were justified in light of historically low interest rates. However, he also warned that if rates were to rise sharply, the stock market could face significant challenges.

Charlie Munger on Federal Fund Rates

Charlie Munger, Buffett’s longtime business partner, has expressed similar thoughts, often in a more blunt manner. Munger is known for his skepticism of short-term market movements and government interventions, but he acknowledges that interest rates deeply influence capital allocation.

In several public forums, including Berkshire Hathaway's annual meetings, Munger has stated that low interest rates lead to speculative bubbles. He has observed that when borrowing is cheap, investors often take on excessive risk, driving up prices of assets like stocks and real estate beyond their intrinsic values. This kind of behavior can lead to market corrections or crashes once interest rates eventually rise.

In a 2021 interview, Munger commented on how ultra-low interest rates during the COVID-19 pandemic had contributed to excessive speculation and inflated asset prices. He said:

“Nobody knows when bubbles will blow up, but just because it’s near zero doesn’t mean it won’t happen.”

He’s also been critical of the long-term consequences of maintaining such low rates, worrying about what might happen when the Fed has to raise rates to control inflation.

Focusing On Long-Term Investing

Both Buffett and Munger emphasize focusing on the fundamentals of businesses rather than speculating on macroeconomic factors like interest rates. While they acknowledge that interest rates are an essential part of valuing businesses, they do not base their investment strategies on short-term movements in the federal funds rate.

Instead, their approach is to invest in high-quality businesses with strong management and competitive advantages (moats) that can perform well across varying economic environments. Their advice is to avoid businesses that are overly dependent on low interest rates for growth, as these companies may struggle if the cost of borrowing rises.

In summary, both Warren Buffett and Charlie Munger view the federal funds rate as a crucial determinant of asset prices and market behavior. While they are fully aware of its implications, their investment philosophy remains focused on long-term business fundamentals, rather than being swayed by short-term changes in monetary policy.

A Perfect Storm: How the Pandemic Triggered a Historic Recession

At the onset of the COVID-19 pandemic in February 2020, the S&P 5001 reached an all-time high of 3,386 points on February 19, 2020. This marked the peak of a long bull market that had been running for over a decade since the Great Recession. However, from mid-February to mid-March 2020, as fears of the pandemic escalated and lockdown measures were introduced worldwide, the S&P 500 experienced a historic drop. By March 23, 2020, the index had fallen to 2,237 points, marking its lowest point during the pandemic sell-off.

In percentage terms, from peak to trough the S&P 500 lost 33.93% of its stock price during this period, making it one of the fastest and sharpest declines in stock market history. This market collapse was driven by widespread uncertainty about the economic impact of the pandemic, fears of corporate earnings plummeting, and a general rotation of capital among investors from stock (considered riskier assets) to bonds (considered safer assets).

The sharp sell-off was classified as a U.S. recession2, according to the National Bureau of Economic Research (NBER) in the U.S.:

The 2020 recession led to unprecedented interventions by the Federal Reserve and central banks globally, as well as fiscal measures from governments, including the U.S.

Preventing a Collapse: U.S. Fiscal Policies That Spurred Recovery

In response to the economic fallout from the COVID-19 pandemic, the U.S. government implemented a series of unprecedented fiscal measures aimed at stabilizing the economy, supporting businesses, and providing financial relief to individuals. The government issued multiple rounds of stimulus checks to individuals, federal unemployment benefits were expanded on top of state benefits, the government introduced the Paycheck Protection Program (PPP) and other measures. These fiscal measures played a key role in preventing a deep recession and fostering a faster economic recovery.

Stabilizing the Economy: How the Fed’s Monetary Policies Responded

In response to the economic shock caused by the COVID-19 pandemic, the Federal Reserve implemented an array of monetary policies to stabilize financial markets, support economic activity, and promote recovery. These measures were designed to provide liquidity, lower borrowing costs, and encourage lending and investment. The two key actions the Fed took can be summarized as:

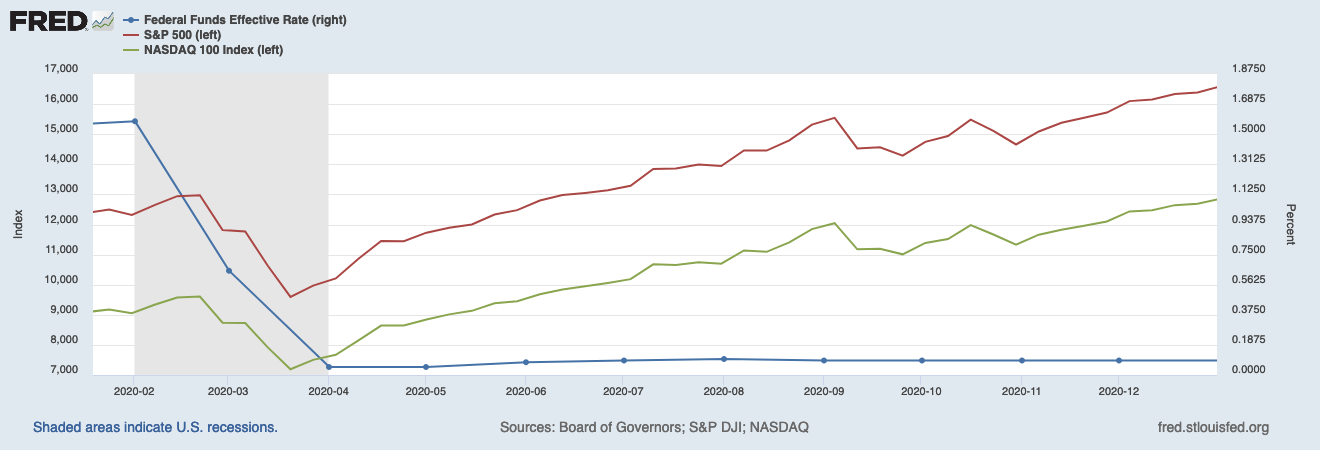

Slashing interest rates: The Fed swiftly cut the federal funds rate to near zero in March 2020, reducing it from a range of 1.50%-1.75% to 0%-0.25%. This drastic move was aimed at lowering borrowing costs across the economy, including for mortgages, auto loans, and corporate borrowing. By making credit cheaper, the Fed encouraged businesses to continue investing and consumers to keep spending, despite the economic downturn. Low interest rates also made it less attractive to hold cash or invest in low-yielding bonds, pushing investors toward riskier assets like stocks.

Data from the Federal Reserve showing the Federal Funds Effective Rate between November 2019 and June 2020 Quantitative Easing (QE)3: The Fed reintroduced and expanded its QE program, purchasing large amounts of U.S. Treasury securities and mortgage-backed securities (MBS)4. By buying these assets, the Fed injected trillions of dollars into the financial system, boosting liquidity. This helped keep interest rates low and supported credit markets by ensuring that businesses, households, and governments could borrow at affordable rates.

Assets in the balance sheet of the Fed from April 2019 to September 2024, showing a spike from around 4.158 trillion USD in February 2020 to 7.168 trillion USD in June 2020, data from Credit and Liquidity Programs and the Balance Sheet, Federal Reserve The QE program had a direct impact on lowering long-term interest rates, making it cheaper for businesses and consumers to borrow money. It also had the effect of driving investors into equities, as yields on bonds dropped to historically low levels, and stocks became more attractive due to their potential for higher returns.

How U.S. Government and Fed Interventions Fueled the Stock Market Rebound

While the interventions of the U.S. government and of the Fed were essential in preventing a deeper economic collapse, they also had a profound impact on stock valuations, risk appetite, and market dynamics. Specifically to the stock market, we witnessed significant market reactions, including a sharp rebound in equities:

Stocks soared: The Fed’s rate cuts, QE program, and liquidity measures fueled a rapid recovery in financial markets. After a sharp sell-off in March 2020, the U.S. stock market rebounded swiftly and entered a bull market. The S&P 500, Nasdaq-1005, and other major indices reached all-time highs by late 2020.

Data from the Federal Reserve overlaying the Federal Funds Effective Rate (blue) to the SP&P 500 index (red) and the Nasdaq-100 index (green) between January 2020 and December 2020 Investors, faced with low yields on bonds and other fixed-income assets, poured money into stocks. Technology stocks, which were already valued for their growth potential, soared as they benefited disproportionately from the low-rate environment and shifts toward digital work during the pandemic.

Bonds offered little return: Treasury yields fell to historic lows as interest rates approached zero. For example, the yield on the 10-year Treasury note dropped below 1%, making newly issued bonds an unattractive investment. As a result, capital flowed from bonds into stocks, further fueling the stock market rally.

Data from the Federal Reserve overlaying the Federal Funds Effective Rate (blue) to the yield on U.S. Treasury note at 10-Year (orange) between September 2019 and December 2020 Risky assets rally: The Fed’s actions created a risk-prone environment, where investors and speculators were more willing to take on risk in search of higher returns. This led to a rally in not only stocks but also other riskier asset classes such as corporate bonds, real estate, and cryptocurrencies. Low interest rates and ample liquidity pushed investors into these markets, fueling price increases across the board.

Avoiding Recession, Fueling Inflation: The Consequences of Pandemic Interventions

The combined effect of the fiscal measures and the monetary policies had a profound impact on the U.S. economy. While the government and the Fed succeeded in stabilizing the economy in the short-term, they also contributed to challenges in the post-pandemic recovery, including rising inflation and concerns about fiscal sustainability:

Prevented a deep recession: Both the fiscal stimulus and the Fed’s monetary actions helped the U.S. economy avoid a deeper recession. The swift injection of cash into the economy through stimulus checks, unemployment benefits, and business loans bolstered consumer spending and provided much-needed liquidity to businesses. The GDP, which contracted by 3.5% in 2020, rebounded by 5.7% in 2021, one of the fastest recoveries in U.S. history.

Data from the Federal Reserve showing the Gross Domestic Product (GDP) percent change year-on-year between 2018 and 2023 Prevented deflation: The Fed’s policies helped prevent deflation, a situation where falling prices can lead to reduced economic activity, as businesses and consumers postpone purchases in anticipation of even lower prices. By maintaining stable prices and low interest rates, the Fed averted the deflationary spiral that could have worsened the economic downturn.

Boosted consumer spending: The direct financial support to households, combined with low borrowing costs, kept consumer spending resilient during the pandemic. Stimulus checks and enhanced unemployment benefits increased disposable income, which allowed consumers to continue spending on goods, even as services like travel and dining were limited. This contributed to a strong recovery in sectors such as retail and durable goods.

Corporate borrowing: Companies issued a record amount of debt in 2020 at incredibly low interest rates, using the proceeds to invest in operations, pay dividends, or repurchase shares. This helped to boost earnings per share (EPS) and supported higher stock prices.

Data from the Federal Reserve showing the corporate borrowings between 3Q2019 and 1Q2024 Increased federal deficit: The fiscal measures, while necessary for economic stabilization, led to a significant increase in the U.S. federal deficit. The U.S. government’s spending programs resulted in a deficit of over $3 trillion in fiscal year 2020, with trillions more added in 2021. This raised concerns about long-term fiscal sustainability, as the government’s debt-to-GDP ratio surged.

Data from the Federal Reserve showing the Total Public Debt as Percent of Gross Domestic Product between 3Q2019 and 1Q2024 Surge in inflation: The combination of expansive monetary policy and massive fiscal stimulus contributed to rising inflation, which began to accelerate in 2021. As the economy reopened and demand surged, supply chain bottlenecks and excess liquidity created inflationary pressures. Year-on-year inflation rose from a low of 0.22% in May 2020 to a peak of 8.99% in June 2022, as measured by the Consumer Price Index (CPI). Inflation in the U.S. reached levels not seen since the early 1980s.

Data from the Federal Reserve overlaying the Federal Funds Effective Rate (blue) to the Consumer Price Index (CPI) for All Urban Consumers (purple) between December 2019 and July 2022 The Federal Reserve eventually had to shift its focus to combatting inflation, leading to interest rate hikes in 2022.

The Risk of Reversals: 2022 Rate Hikes

Inflation in the U.S. peaked at 8.99% in June 2022, driven by a combination of factors that culminated in significant price increases across many sectors of the economy. First, global supply chain disruptions from the COVID-19 pandemic continued well into 20226, causing shortages of key goods such as semiconductors, which affected a wide range of industries from electronics to automotive. Second, energy prices surged due to Russia’s invasion of Ukraine in February 2022, which led to disruptions in global oil and gas supplies, spiking the cost of fuel and energy.

Additionally, pent-up demand for goods and services following lockdowns, coupled with large amounts of fiscal stimulus from governments around the world, fueled consumer spending. This high demand collided with constrained supply, leading to rising prices across multiple sectors, including food, housing, and transportation.

Fed’s Response: Aggressive Rate Hikes and Quantitative Tightening in 2022

In response to these inflationary pressures, the Federal Reserve took aggressive action to curb inflation. Starting in March 2022, the Fed initiated a series of interest rate hikes, raising the federal funds rate from near-zero levels. By July 2022, inflation showed first signs of coming down, meanwhile the Fed had already raised rates to 1.68% and would continue raising them throughout the year to slow down economic activity and reduce demand.

The Fed also began reducing its balance sheet, a process known as quantitative tightening7, to drain excess liquidity from the financial system. These actions were intended to cool down the overheated economy and bring inflation back toward the Fed’s 2% target.

Effects on the Stock Market of 2022 Rates Hikes

When the Federal Reserve began raising interest rates in March 2022 to combat soaring inflation, the stock market experienced significant volatility and a notable decline. The initial 25 basis point rate hike, the first since 2018, was the start of a series of aggressive increases, which led to investors’ concerns about higher borrowing costs and slowing economic growth. Higher interest rates tend to negatively affect stock valuations, especially for growth stocks, as the future earnings of companies are discounted at a higher rate, reducing their present intrinsic value.

The S&P 500 and the Nasdaq-100 index both experienced sharp declines in response to the rate hikes. The tech-heavy Nasdaq-100, in particular, which houses many high-growth companies, fell into a bear market (a decline of 20% or more from its peak) as investors rotated away from allegedly riskier assets and into more stable, income-generating assets like bonds. By July 2022, the S&P 500 also entered bear market territory, having dropped more than 20% from its all-time high in January of that year.

Sectors like technology and consumer discretionary were hit the hardest, as these industries tend to rely on cheap financing for growth. On the other hand, defensive sectors such as utilities and consumer staples fared better, as they are less sensitive to changes in interest rates. The uncertainty surrounding the pace and extent of future rate hikes contributed to ongoing market turbulence, with investors increasingly worried about the potential for a recession as the Fed tightened monetary policy. In summary, the gravitational pull of higher interest rates pulled valuations back down, resulting in a short bear market.

Defying Gravity: Why Stocks Continued to Rise Despite Rising Interest Rates

Despite interest rates surpassing 5% in May 2023 and remaining flat through mid-September 2024, stocks continued to climb from October 2022, driven by several underlying factors. One key reason was the resilience of corporate earnings8, particularly in sectors like technology and energy, where companies demonstrated strong profitability and pricing power. This helped support investor confidence even as borrowing costs rose. Additionally, the U.S. economy showed strength, with robust labor markets (unemployment rate fluctuating between 3.4% in January 2023 and 4.3% in July 2024) and sustained consumer spending9, which alleviated fears of an immediate recession.

Another important factor was the large amount of excess liquidity in the financial system, a result of both the pandemic-era stimulus and consumer savings. Even as rates increased, trillions of dollars remained in money market funds and bank accounts, providing a buffer for continued investment in equities. Moreover, many investors and businesses had locked in long-term, low-interest-rate debt before the rate hikes, mitigating the immediate impact of higher rates on borrowing costs for both individuals and businesses.

The Fed’s Strategic Pivot: A 50-Point Rate Cut to Balance Inflation and Employment

On September 18, 2024, the Fed made its first interest rate cut in over four years10, reducing the federal funds rate by 50 basis points, bringing it to a range of 4.75% to 5%. This marked a significant shift in the Fed’s strategy after a prolonged period of high rates aimed at combating inflation. The decision to cut rates was driven by several factors, most notably slowing inflation, which had dropped closer to the Fed's target of 2%, and concerns over a weakening labor market, as job gains had begun to slow.

The Fed’s decision to implement a larger-than-expected rate cut was also influenced by worries about the potential impact of persistently high borrowing costs on the economy. The central bank wanted to balance controlling inflation while supporting growth and preventing a significant rise in unemployment.

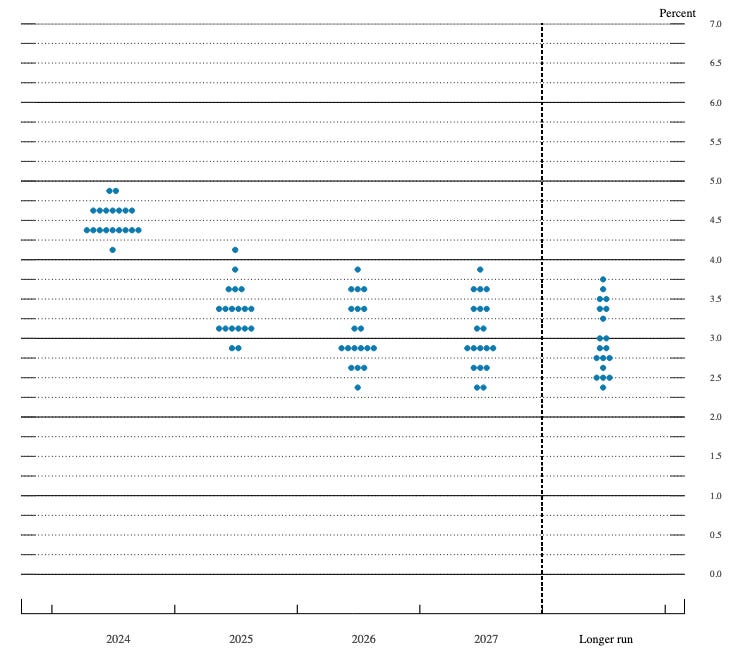

Economic Projections from the September 2024 FOMC Meeting

Looking ahead, the Fed signaled plans for further rate cuts, as the economic outlook continued to present challenges such as rising unemployment. The projections from the September 2024 Federal Open Market Committee (FOMC) meeting indicate the following key expectations for the U.S. economy:

GDP growth: Expected to remain stable at around 2% annually from 2024 through 2027.

Unemployment rate: Projected to slightly increase to 4.4% in 2024 before gradually declining to 4.2% by 2027.

Inflation: Forecast to decrease to 2.3% in 2024 and reach the Fed’s long-term target of 2% by 2026.

Federal funds rate: Expected to drop from 4.4% in 2024 to 2.9% by 2026.

These projections highlight the Fed’s goal of stabilizing inflation while balancing economic growth and employment.

What am I doing in a Lowering-Rate Environment?

This month, the Fed cut interest rates, creating a lower-rate environment. Despite these short-term dynamics, I believe that investing in high-quality businesses remains essential for long-term success. While lower rates may make stocks appear more attractive in the short term, chasing short-term gains can lead to overpaying for stocks, potentially harming future returns.

My focus remains on quality: companies with strong management teams, durable competitive advantages (moats), and long-term growth prospects. Businesses with these qualities tend to perform well over time, regardless of whether interest rates are high or low. Importantly, these companies don’t rely on cheap debt to grow; instead, their core businesses are robust enough to thrive in a variety of economic conditions.

Falling interest rates don’t mean I should rotate out of certain stocks in my portfolio. In fact, I believe that businesses that perform well only when rates are low aren’t quality businesses. My strategy is to avoid reacting impulsively to rate cuts and to remain invested in companies that are resilient in all economic environments.

While lower interest rates often push stock prices higher, they also compress earnings yields, which reduces the potential for future returns. High stock prices may feel reassuring in the short term, but for level-headed investors, higher valuations translate into fewer opportunities to buy stocks at fair prices. That’s why I plan to stay focused on valuations and ensure I’m getting an adequate return on the stocks I purchase.

Conclusion

Understanding how interest rates influence asset prices and the broader economy is crucial for any investor. As Warren Buffett famously compared, interest rates act like gravity on financial markets, when they are low, they allow asset prices to rise, but as they increase, they exert downward pressure on valuations. Both Buffett and Munger emphasize the importance of focusing on the long-term fundamentals of businesses rather than trying to time the market based on changes in the federal funds rate.

As we’ve seen, the Federal Reserve's policies, whether cutting rates during economic downturns or raising them to control inflation, play a pivotal role in shaping stock market behavior. While low interest rates tend to push stock prices higher by making borrowing cheaper and bonds less attractive, I suggest a cautious approach to the risks of overpaying for stocks in the short term.

In the end, the key to successful investing, as stressed by Buffett and Munger, is to concentrate on high-quality businesses with durable competitive advantages that can withstand a variety of economic conditions. By maintaining this long-term, disciplined approach, I aim to navigate both rising and falling interest rate environments without succumbing to short-term market pressures.

The S&P 500 (Standard & Poor's 500) is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. It is widely regarded as one of the best indicators of the overall health of the U.S. stock market and a proxy for the broader stock market, reflecting the performance of companies across various industries.

A recession is a significant decline in economic activity across the economy, lasting more than a few months. It is typically recognized by a drop in key economic indicators such as gross domestic product (GDP), employment, industrial production, and wholesale-retail sales. In the U.S., the National Bureau of Economic Research (NBER) is the organization that officially declares recessions, considering a variety of economic data rather than solely relying on two consecutive quarters of GDP decline, which is a commonly used but informal rule of thumb.

Quantitative Easing (QE) is a monetary policy tool used by central banks, including the Federal Reserve, to stimulate the economy when standard interest rate cuts are insufficient. Under QE, the central bank purchases large amounts of financial assets, such as government bonds and mortgage-backed securities, from the open market. This increases the money supply, lowers interest rates, and injects liquidity into the financial system. The goal of QE is to encourage lending and investment, boost economic activity, and combat deflation or low inflation during economic downturns.

Mortgage-backed securities (MBS) are financial instruments created by bundling together a group of home loans and selling them to investors. The payments made by homeowners on these loans (both principal and interest) are passed through to the MBS investors. MBS are a way for banks to offload mortgage risk and raise funds for new loans.

The Nasdaq-100 is a stock market index that tracks the performance of the 100 largest non-financial companies listed on the Nasdaq stock exchange. The index is heavily weighted toward technology and includes major companies such as Apple, Microsoft, Amazon, Tesla, and Meta. While primarily tech-focused, the Nasdaq-100 also includes companies from sectors like consumer services, healthcare, and telecommunications. It's often used as a benchmark for the performance of large, high-growth companies, especially in the technology sector.

How COVID-19 impacted supply chains and what comes next by Ernst & Young LLP.

Quantitative Tightening (QT) is a monetary policy tool used by central banks, including the Federal Reserve, to reduce the amount of liquidity in the financial system. It is the opposite of Quantitative Easing (QE). Under QT, the central bank reduces its balance sheet by allowing bonds and other financial assets (purchased during QE) to mature without reinvesting the proceeds or by selling them directly. This process reduces the money supply, raises interest rates, and aims to tighten financial conditions, often to combat inflation or an overheated economy.

For most of 2023, even amid macroeconomic headwinds, the percentage of S&P 500 constituents surpassing EPS expectations vs. S&P Capital IQ Estimates increased. Performance throughout 2023 appeared to be a sign of the U.S. market’s resilience. Reference: S&P 500 Q4 2023 Sector Earnings & Revenue Data by S&P Global.

As the U.S. Consumer Goes, So Goes the U.S. Economy by The White House.