CoreWeave (CRWV) Q3 2025: When The Interest Bill Becomes the Story

Why I'm not a shareholder: no moat, commoditized returns, and execution risk in a levered build-out

When I wrote When Growth Runs on Debt: The CoreWeave Case Study the core point wasn’t that AI infrastructure demand is fake. It’s that the economics of a GPU-rental neocloud can look phenomenal in revenue charts while the underlying machine runs on leverage, rapid asset obsolescence, and constant refinancing.

Since the March 2025 IPO, the CoreWeave (CRWV 0.00%↑) stock has lived that tension in real time - sharp post-IPO upside, then a violent repricing as investors started focusing on funding costs and execution risk rather than growth slogans.

Q3 2025 in One Sentence: Revenue Doubled, Operating Income Fell

On the headline numbers, Q3 2025 was spectacular: revenue was $1.4 billion, up 134% year-over-year (YoY), and backlog was $55.6 billion.

But the income statement tells the less-market-friendly version: operating expenses also exploded to $1.3 billion (+181% YoY), leaving GAAP operating income at $51.9 million, down 55.6% from $117 million a year ago: more growth but less operating income.

This is the Buffett line in numbers: “not all growth is good growth”, especially when the expense structure (and financing structure) grows faster than the underlying profitability.

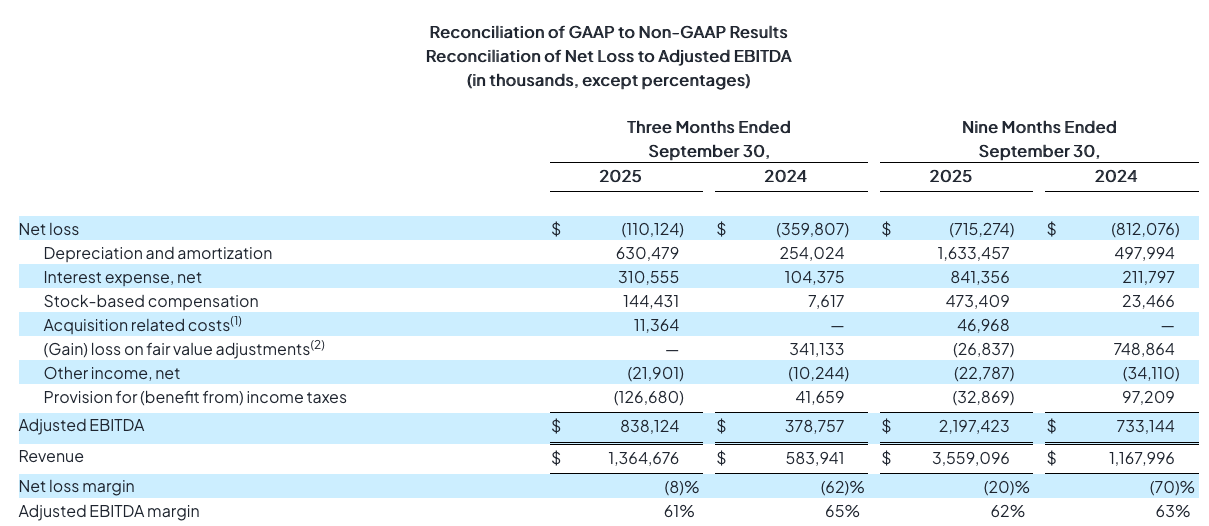

In my original piece, I flagged the trajectory: rising debt would drag interest expense from large to structural, and eventually force the business to run for its lenders before it can run for shareholders. Q3 2025 makes that concern concrete: Interest expense was $310.6 million in Q3, nearly 3x the $104.4 million in Q3 2024. As a share of revenue, that’s about 23%. For the first nine months of 2025, interest expense was $841.4 million, up 297% versus the prior year period. Cash paid for interest (net of capitalized amounts) was $557.1 million year-to-date (YTD), versus $97.4 million the year before; showing this isn’t just an accounting artifact.

This is exactly what “growth funded by debt” looks like once rates and borrowing levels catch up: the financing line starts consuming the income statement.

Adjusted EBITDA: The Clean-Looking Metric That Removes the Messy Reality

CoreWeave’s Q3 2025 earnings deck leads with $838 million of adjusted EBITDA (61% margin). The problem is that for a business where assets age quickly and the fleet must be refreshed continuously to stay competitive, depreciation is economically closer to a recurring reinvestment requirement than a disposable, non-cash nuisance; precisely the point I made in the original article.

In Q3, depreciation and amortization on property & equipment was $630.5 million for the quarter. Add that to the $310.6 million of interest expense, and you get $941 million, about 68.9% of quarterly revenue; before you even factor in taxes.

When those two lines are treated as “below the line” and effectively ignored in the headline narrative, the business can look far more profitable than it is.

Cash Flow and CapEx: the Business is Still Not Self-Funding

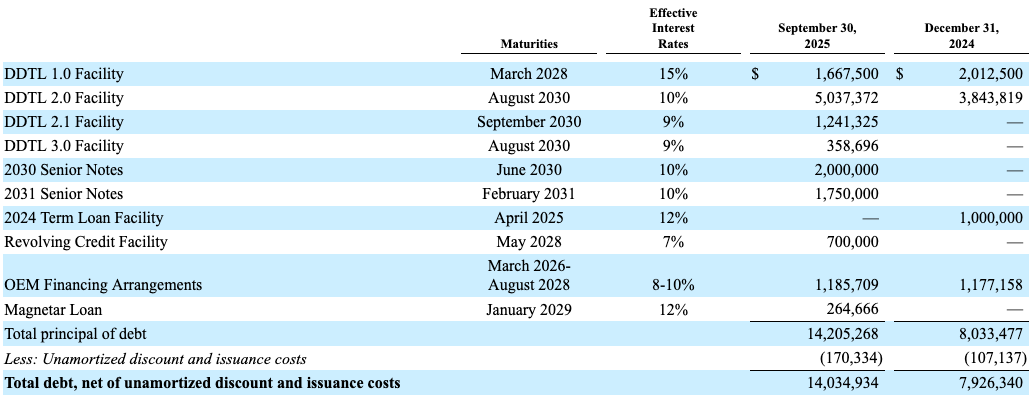

CoreWeave generated $1.5 billion of operating cash flow (OCF) in the first nine months of 2025, down from $2.6 billion the year before. It spent $6.25 billion on purchases of property & equipment (CapEx) over the same period. The business model remains the same: operating cash helps, but the expansion plan overwhelms it, producing deeply negative free cash flow that must be bridged with debt. YTD proceeds from issuance of debt were $7.6 billion, with $3 billion of repayments. The company also discloses in their Q3 10-Q filing that debt-service cash flows totaled $3.6 billion YTD, including $3 billion of principal payments and $651 million of interest payments (including capitalized interest).

Balance Sheet: the Refinancing Question Didn’t Go Away, It Moved Closer

At September 30, 2025, total current assets were $4.7 billion, while total current liabilities were $9.7 billion, about a $5 billion gap, with $3.7 billion of current debt inside those current liabilities. Total debt (current + non-current) was $14 billion at quarter-end. This compares uncomfortably with the framing from my original article: a business whose “growth engine” requires external capital staying continuously available, at tolerable rates, while the asset base depreciates rapidly.

The “more debt” drumbeat hasn’t stopped after quarter-end: in December 2025, CoreWeave priced an upsized $2.25 billion convertible senior notes offering.

Execution Risk Meets Leverage: Capacity Delays Are Not Harmless in This Setup

During the Q3 earnings call, CoreWeave trimmed its outlook due to delays at a third-party data center partner. In a lightly levered model, delays are annoying. In a heavily levered, high-CapEx model, delays can become financially meaningful because you keep paying interest while the revenue you expected to support that interest arrives later.

CoreWeave announced an all-stock deal to acquire its data center partner Core Scientific in July 2025, explicitly tying it to scale, control, and cost of capital. But Core Scientific (CORZ 0.00%↑) shareholders ultimately voted it down and the deal was terminated in late October 2025, leaving CoreWeave still exposed to partner execution while maintaining the same broad leverage posture.

What Changed Since My Original Article? The Numbers Caught Up

If you strip this follow-up down to the thesis test:

Debt has continued to expand - $14 billion of debt on the balance sheet at September 30, 2025, plus additional post-quarter financing activity.

Interest costs are rising fast and have become a major share of revenue - 23% in Q3.

The company’s preferred profitability framing still leans on adjusted metrics that, by design, step over depreciation and financing - the two expenses most tightly coupled to long-term economics in this kind of business.

Final Thoughts: Obvious Growth Still Isn’t Obvious Returns

AI infrastructure demand can be real and enormous, and still be a tough place for shareholders if the industry’s returns get competed away while financing costs compound. CoreWeave’s Q3 2025 filing makes that trade-off sharper, not softer: faster scaling, heavier capital intensity, higher interest burden, and more reliance on continuous access to capital markets.

I am not a CoreWeave’s shareholder, and I do not intend to become one. More broadly, I have no interest in owning “GPU renters” as a category. As I argued in my original article, I struggle to see an intrinsic moat in a business model where the core assets are purchasable by anyone with capital, the product is largely a commodity (compute), and differentiation risks collapsing into price, financing access, and execution. In that setup, even strong demand can translate into mediocre investor economics.

The next few quarters, I’d watch three things more than revenue figure and adjusted EBITDA: interest expense and cash interest paid, net debt growth versus incremental gross profit, and whether CapEx intensity falls fast enough to credibly point toward durable free cash flow, without requiring one more major debt raise.

CoreWeave has to spend 20 Billion from September 30th 2025 to March 31 2026 and they only have $14 Billion in available funds to do it. I have a detailed report below if you want to see the details.

https://mschief1994.substack.com/p/a-deep-dive-into-coreweaves-cash?r=70b06y

I believe CoreWeave has a high probability of filing for Bankruptcy in 2026. The business is in far worse shape today than the public knows. Here are 5 key issues it is facing that cumulatively will lead to its insolvency next year.

1. The Cashflow Problem

A major problem CoreWeave has is its cashflow. CoreWeave sold its future to fund its growth. Customers have already pre-paid, and the money they paid is already spent. For Example, Open AI has prepaid over $2 Billion to CoreWeave for credits that it will slowly burn through over 2 years. While CoreWeave will recognize that $2 billion as revenue they will get no cash from Open AI as Open AI will just be burning through credits. The $5.3 Billion in deferred revenue on CoreWeaves balance sheet will go down, and revenue will be recognized, but they will get no cash until those pre-paid credits are used up. This leaves no cash for CoreWeave to pay its operating expenses, or pay its amortized DDTL Loans, much less continue the $28-30 Billion in Capex they have forecasted. They are almost certainly going to have to lower the Capex and renegotiate the contracts they have with customers to survive this. While reported revenue numbers will look good the company will be in great financial stress.

2. The Credit Problem

They already have junk status with all the major rating agencies, and CDS spreads are projecting a 42% chance of default in the next 5 years (I think it is closer to 45% this year). They have $3.7 billion in current debts due 12 months from September 30th, 2025 (per the most recent 10q). Based on table 10. “Debt” in the 10q about $2.6 billion of that is amortized payments on its DDLT loans and the other is a large balloon payment of OEM Financing Arrangements from Nvidia and Dell. They have the maturities of these financing arrangements listed as due March 2026-August 2028 but given the amount of current debt they show this is extremely misleading. Almost 100% of the OEM financing debt is due in the first half of 2026. Keep in mind that as of September 30th the DDTL loans are not fully drawn, and that amortization payments on those loans start Q1 of 2026. When those loans are fully drawn current debt will rise dramatically.

Having said all of that, they do not have near enough cash to cover these payments along with operating expenses, which is why they had to have their minimum liquidity levels lowered to $100 million to avoid technical default. Furthermore, they have cross collateralized the DDTL loans with the entire company. This will likely prevent them from being able to issue more bonds or convertible bonds. This cross collateralization gives the DDTL lenders first position on chips and either first position or equal position to bondholders on the rest of the company.

This is why they need unlimited equity cures to get through the next few months. They need to be able to print stock to not default on DDLT Loans. This is all noted in the 8k reported in early January discussing the modification of CoreWeave’s DDTL loans.

3. The Equity Problem

I can send you a PDF that goes into greater detail on this, but basically the founders are converting founders shares into sellable class b shares at a clip of about 9 million shares a quarter. On top of this Magnetar, a big early investor, is selling about 27 million shares a quarter, and Magnetar along with the 3 founders already have presold shares in a VPF contract that will hit the market on June 19, 2026. In addition to this they have a 6% evergreen provision that automatically adds 6% of the total share count on Jan 1 that goes to help employees. (5% Equity and 1% Employee Stock Purchase Plans) Another 29.8 million shares. They will also need to print at least 62 million shares (assuming the stock prices stays around $78) just to survive the year. In reality they probably need much more but let’s be conservative. That means with insider selling and new shares issued, the new supply of shares will be close to 215 tradable shares. Just newly printed shares will be around 91 million. With current outstanding shares at 497 million existing shareholders will be diluted by at least 18% and the tradable share float will go up 43%. Not great for existing shareholders.

4. The Contract Execution and Construction Timing Problem

The fourth problem they have is their inability to meet deadlines and deliver on contracts. They have strict contract realization deadlines that they have to meet to secure DDTL Financing. They have to show billings by February 28, 2026, to be able to collect the remaining money on the DDTL Loans. The big one is the DDTL 3.0 loan for the Denton Open AI Facility. They cannot actually get the money from the DDTL Loan to pay suppliers until they show revenue, but they are 60-90 days behind schedule. They have cited “Weather Delay” which I believe to be totally bogus. The real reason for the delay is the redesign of the facility to meet the liquid cooling requirements of the new Blackwell chips.

Having said that, the Shell for the Denton facility was delivered to CoreWeave per The Texas Department of Licensing and Regulation permit issued on December 29th, 2025. (See the link to the permit below.) This was the final step for Core Scientific, the landlord to deliver the shell and begin collecting lease payments. It will take 5-6 months potentially to build out the facility, and to get all the chips up and going. This means that they will not be able to bill Open AI for at least 5 months. If they cannot get the facility up and running by March they will have to start paying Open AI penalty payments in the form of compute credits, if they do not have it up and running by May 1, 2026 Open AI can cancel the Denton Contract, and if it is delayed until July 1, 2026 they can terminate all deals with Coreweave. I do not believe Open AI will cancel the deal because they have already pre-paid for so much compute at such low rates. The penalties could add up to a significant number though for Coreweave further pushing out its cashflow.

The timing is a big problem for CoreWeave’s cashflow. This is where the unlimited equity cures come in. They cannot bill open AI because they are not finished installing the chips, and they cannot get the money from the DDTL loans to pay their suppliers until they bill Open AI. So, what the banks have allow them to do is substitute these “Billings” with stock sales to the open market to generate cash that will give CoreWeave liquidity to pay the banks. This is not an option. They have to do this to get their money even if they have cash in the bank to pay the loan. If they do not issue equity cures to replace billings the bank will not fund the remaining portion of the DDTL Loans. The Denton facilities billings alone are estimated to be around $100 Million /month conservatively. That means at a minimum $100 million in stock that must be issued per month of delays just to satisfy the banks and get funding. This is just for the open AI Denton, TX project. CoreWeave has 3 of these going at the same time in similar stages. Their sites at Ellendale, ND and Lancaster, PA are also experiencing similar delays.

In my opinion construction delays and contract timing risk are potentially the biggest of all the issues CoreWeave has in the short term. They could blow everything up very quickly.

5. Their Margins Suck

For this I lean on others’ research. The Kerrisdale Capital Report posted on September 15, 2025, lays everything out pretty well. Micheal Burry also has a similar view that the depreciation schedule companies are using for these chips is far to long. Basically, what they say is that reported margins are roughly 20% based on a 6 year chip life cycle, but margins are essentially 0% because the chips only actually last 4 years. Also, CoreWeave will not realize any free cashflow from its chips for 3 years due to harsh amortization schedules and high interest rates on its DDTL loans. By the time they get the DDLT loans paid off they will have made 0 money on their chips, and they will basically be worthless.

Kerrisdale Report

https://www.kerrisdalecap.com/wp-content/uploads/2025/09/Kerrisdale-CoreWeave.pdf

Employee Benefit Plan Filing

https://www.sec.gov/Archives/edgar/data/1769628/000119312525058309/d899798dex103.htm

The Texas Department of Licensing and Regulation Permit

https://www.tdlr.texas.gov/TABS/Search/Project/TABS2025005706