Brookfield's Investor Day 2025: A Blueprint for Compounding Decades Ahead

AI infrastructure, investment-led insurance, a recovery in real estate, and a conservative balance sheet powering the next growth leg

Brookfield Corporation (BN 0.00%↑) held its Investor Day on September 10, 2025. The market’s reaction was swift, the stock rose 3%, to new all-time highs. Beyond the near-term price response, the presentation reinforced why I remain a long-term shareholder and why Brookfield continues to anchor my portfolio.

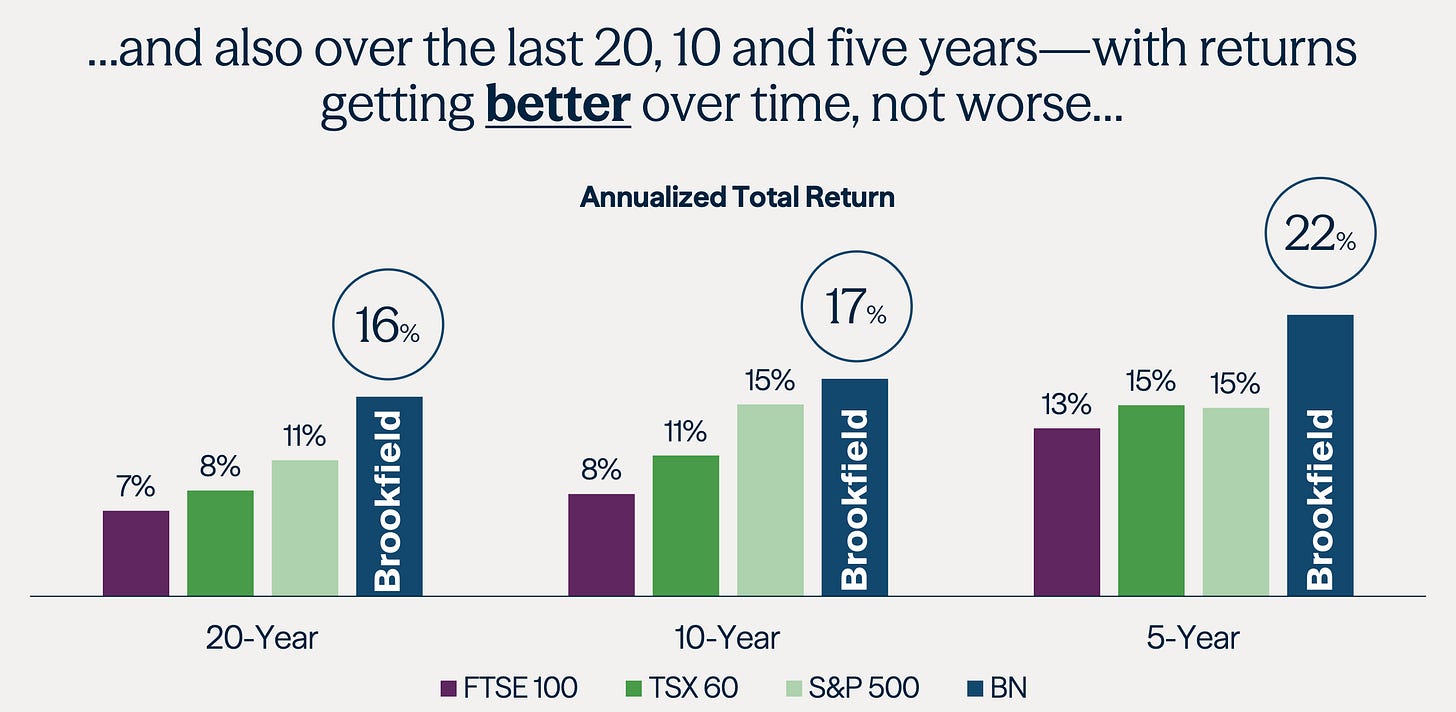

For more than three decades, Brookfield has compounded shareholder value at 19% annually - that would have turned $1,000 into $270,000 in 30 years.

As Benjamin Graham put it, “In the short run, the market is a voting machine; in the long run, it is a weighing machine”. The 3% pop around Investor Day was the voting; three decades of disciplined compounding is the weighing - real cash flows, durable assets, and steadily expanding base of fee-bearing and perpetual capital being valued over time. As CEO Bruce Flatt put it:

“Our 20-year returns are 16%, our 10-year returns are 17%, our five-year returns are 22%. What it means is the business is maturing and getting better over time. Scale actually is assisting us getting better returns.”

That consistency comes from a long-term investment philosophy that blends value investing, operational excellence, and methodical capital allocation. It echoes Jeff Bezos’s idea point about ignoring short-term market applause to build a “heavy” company. I see it in Brookfield’s growth engines: fee-related earnings and carry from Asset Management, insurance float compounding within Wealth Solutions, and the continued expansion of real asset platforms, such as infrastructure, power, and real estate, in both operations and financial weight. Over time, that accumulated mass pulls intrinsic value, and eventually market price, higher.

Management framed the company’s next chapter as a transformative phase of growth, powered by three global trends:

AI-driven infrastructure investment.

Aging demographics fueling new wealth and retirement products.

A global real estate recovery.

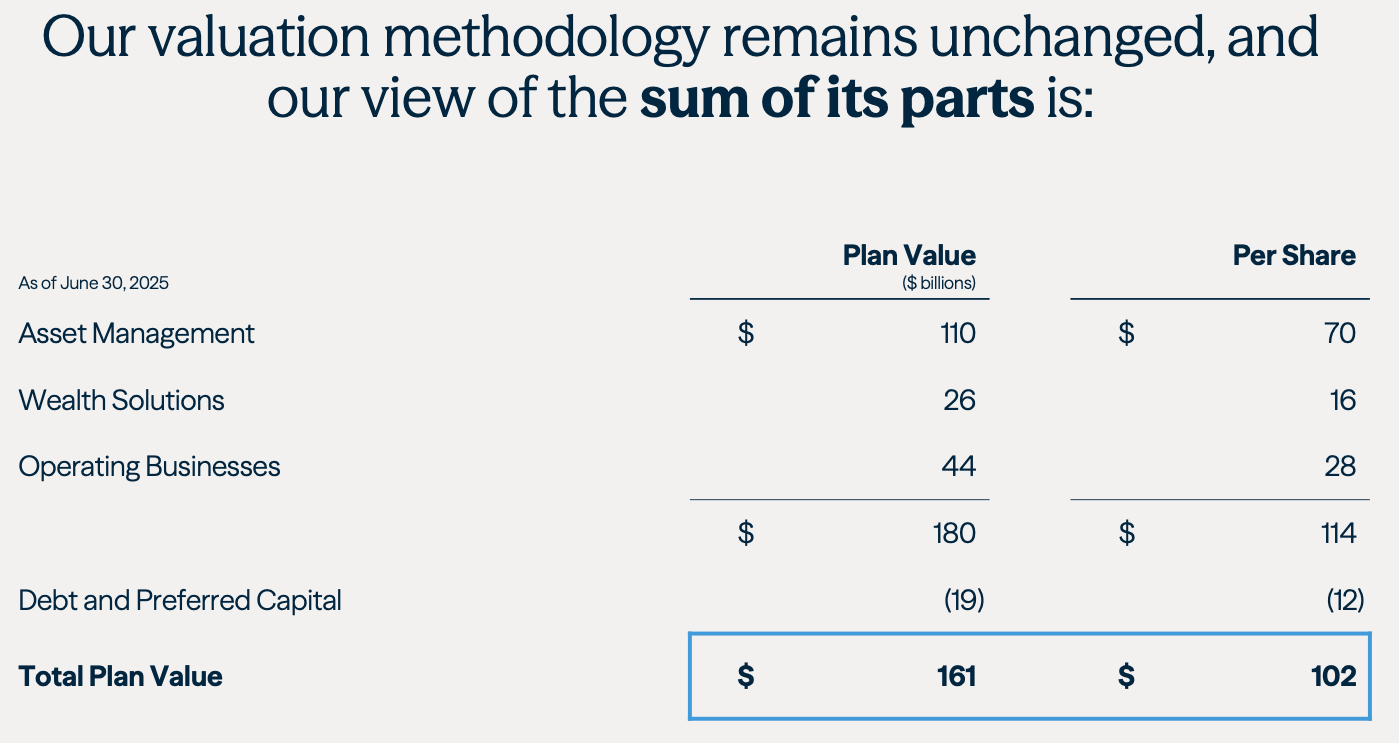

Brookfield is targeting 25% compound annual growth (CAGR) in Distributable Earnings (DE) per share and 16% annual plan value1 growth from $102/share to $210/share (pre three-for-two stock split) by year-end 2030; goals the team reiterated throughout the day.

Finding Trends, Packaging Products, Deploying at Scale

Brookfield’s innovation playbook is disarmingly simple: spot global secular trends, productize them for clients, then deploy capital at scale. As Flatt put it, they “identify the trends on a big, global basis […] package them into products for our clients, which then enables us to attract scale capital within each sector”.

Crucially, Brookfield doesn’t try to be the earliest; it aims to be fast once it understands an industry. That readiness-to-scale is a competitive edge: “We’re not early, but once we understand it, we move fast, and we deploy at scale”. It’s an approach that has repeatedly expanded the company’s opportunity set, “50% of the assets that we operate with today didn’t exist as an asset class for investible purposes 15 years ago”.

Even as Brookfield widens into adjacent strategies to meet differing return profiles, the investment approach stays consistent: “operate with a value investing thesis taking moderate risk, aligning ourselves with our constituents, using our operating skills to squeeze extra returns out of it […] a methodical and proven capital allocation process […] and, probably most importantly, the culture we have in the organization is extremely important”.

AI Factories: Power, Property, and Patient Capital

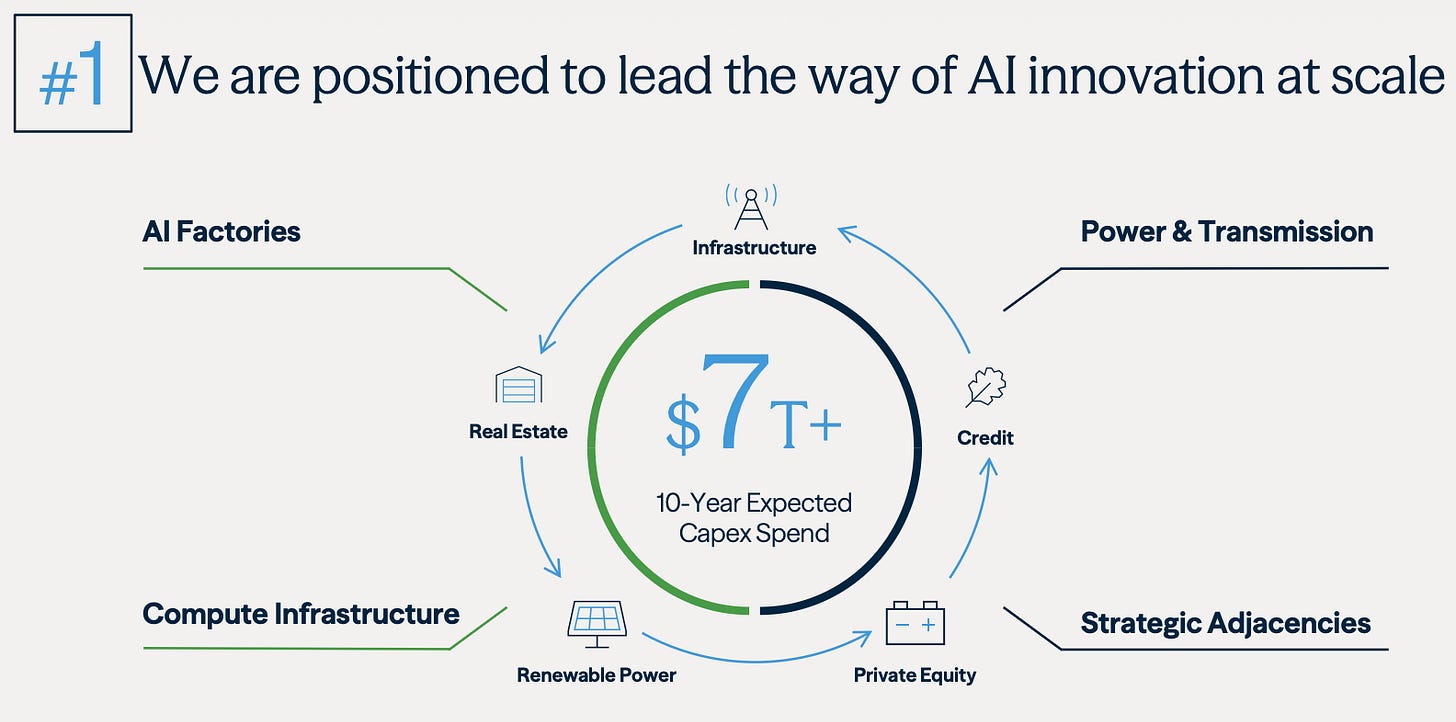

Brookfield sees AI infrastructure as a generational opportunity — the new railroads, highways, and water systems of the next decade. The company has identified seven large-scale AI factory sites, representing 6GW of compute and ~$200 billion of investment across North America, Europe, and the UK.

Flatt’s remarks put a point on the scale and runway:

“On AI […] This is a $7 trillion opportunity […] We have a number of AI factories that we’re working on, which is around a $200 billion investment project […] This is a multi-decade opportunity that possibly is the largest business within our company within 10 years.”

Given hyperscalers’ power constraints and Brookfield’s integrated capabilities (power, transmission, real estate, and capital), the business is positioned to be a critical enabler of AI infrastructure for years.

Bringing Alternatives to Individuals

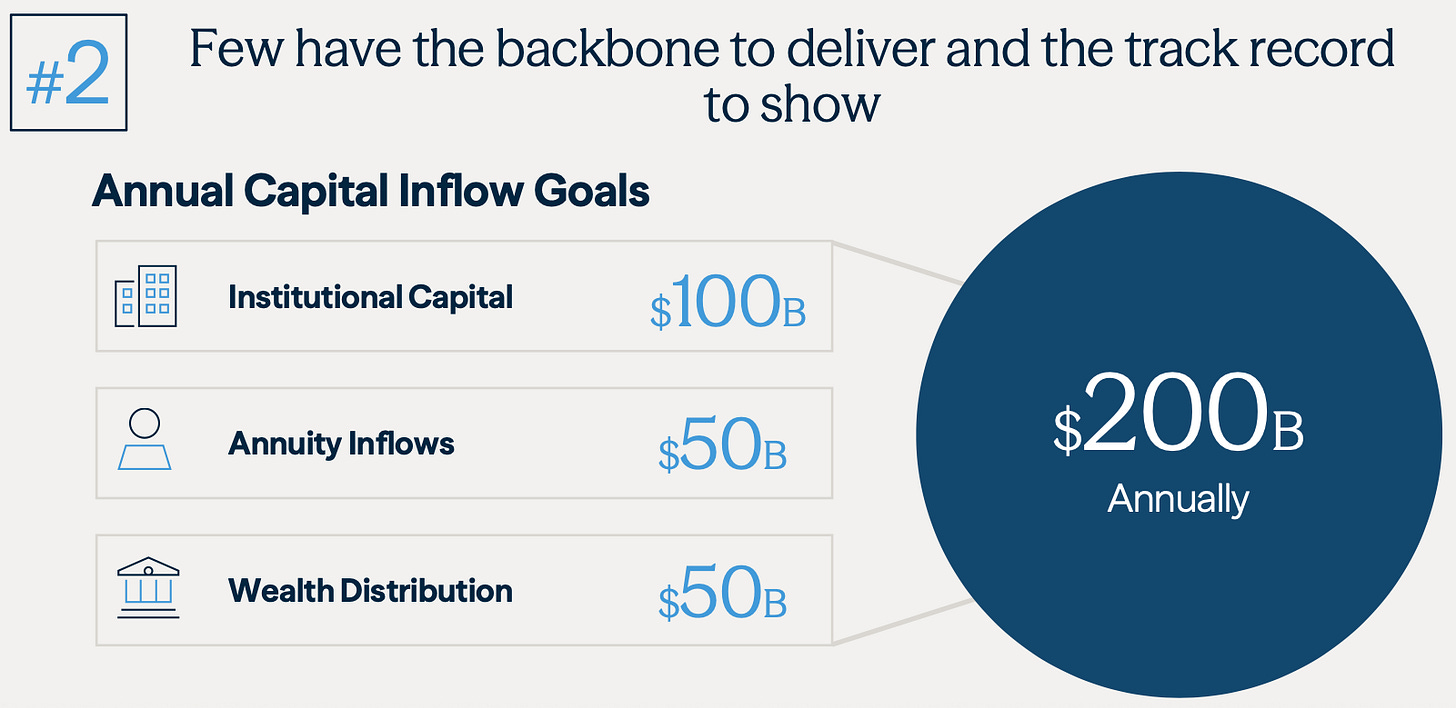

Brookfield highlighted a rising pool of capital beyond institutions and its own balance sheet: individual investors (401(k), annuities, private wealth). Flatt described both the size and the shift:

“Pension plans and sovereign plans […] is a $22 trillion market. 401(k)s and wealth is $40 trillion. We expect this third source of capital to support a doubling of the inflows […] $100 billion from institutional funding annually, $50 billion from annuities, $50 billion from wealth. That’s about double of what we’ve done generally in the past.”

Brookfield plans to capitalize on this shift through new products designed to bring the benefits of private investing to individuals, generating a long runway that compounds fee-bearing capital and deepens client relationships. The business’ decades-long track record managing private assets positions it as a natural leader in this emerging space. This segment is part of Brookfield Wealth Solutions, discussed below in this article.

Real Estate: Playing Offense Into the Recovery

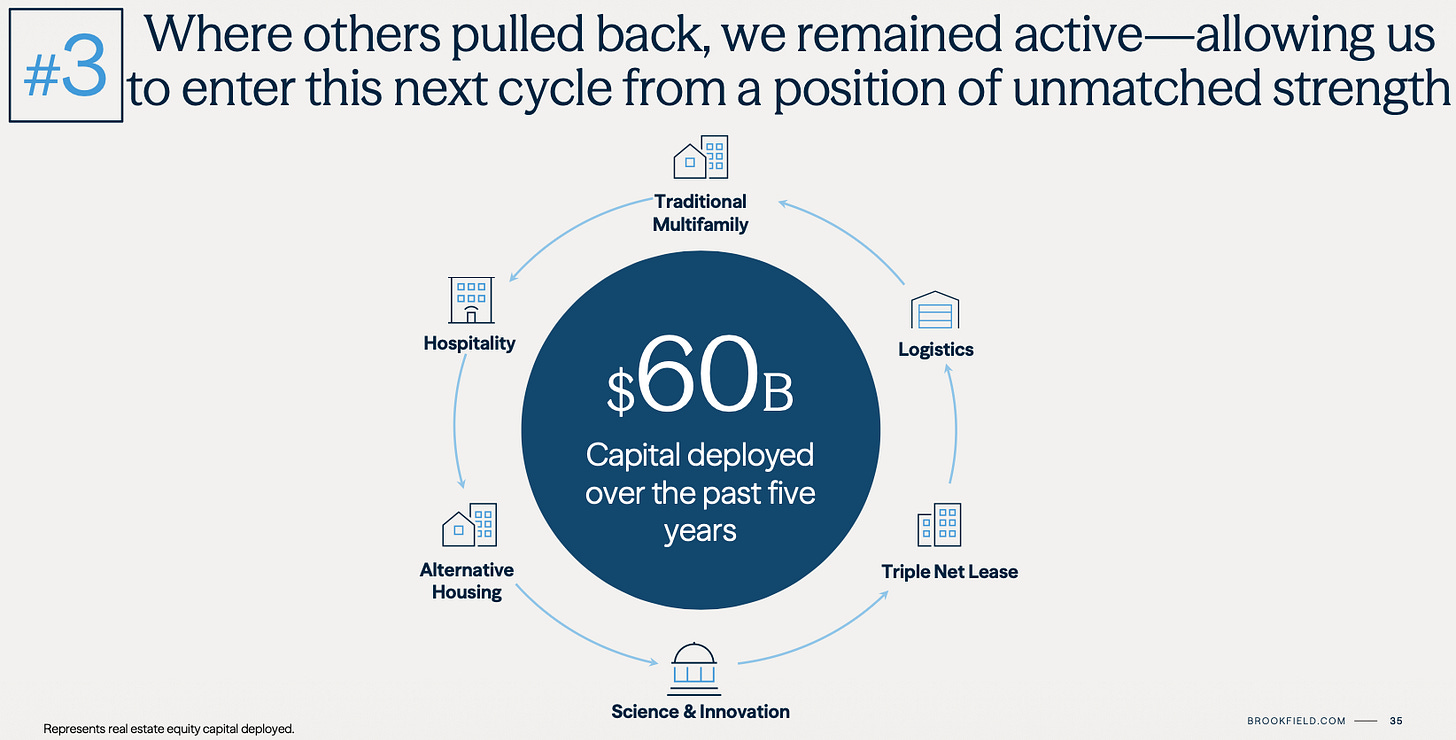

Real estate has been one of Brookfield’s defining competencies. While many peers have pulled back amid tighter credit and higher rates, Brookfield continued to deploy capital, roughly $60 billion over the past five years, across logistics, multifamily housing, hospitality, and life sciences properties.

The team emphasized that fundamentals are firming and transaction activity is returning. Kevin McCrain, who leads Real Estate, was direct:

“Our portfolio of premier real estate assets is well positioned to deliver strong earnings growth during the plan period. We anticipate generating $24 billion of capital through transactions during the plan period.”

Within the portfolio, Brookfield now segments balance sheet’s real estate into Super Core, Core Plus, and Value Add. The Super Core group (34 premier assets) runs at 95% occupancy with $19 billion of equity and the Core Plus set (57 assets) runs at 94% occupancy and carries $8 billion of equity.

On the ground, leasing and rent trends are tightening as new supply remains constrained and return-to-office policies normalize:

“Today, over half the companies have a fully in-office work requirement […] That becomes a significant premium for new office space […] We are signing leases […] over $250 a foot [in NYC] and over £150 per foot [in London].”

The company believes this disciplined activity leaves it in a position of “unmatched strength” as the next cycle begins. Real estate, historically cyclical, has often been a source of outsized returns for patient allocators willing to invest when sentiment is poor, and that approach fits perfectly within Brookfield’s contrarian, value-oriented DNA.

BWS: Building an Investment-Led Insurance Flywheel

One of the standout presentations came from Sachin Shah, CEO of Brookfield Wealth Solutions (BWS), who outlined why Brookfield built this business five years ago, and why it’s now central to the company’s future.

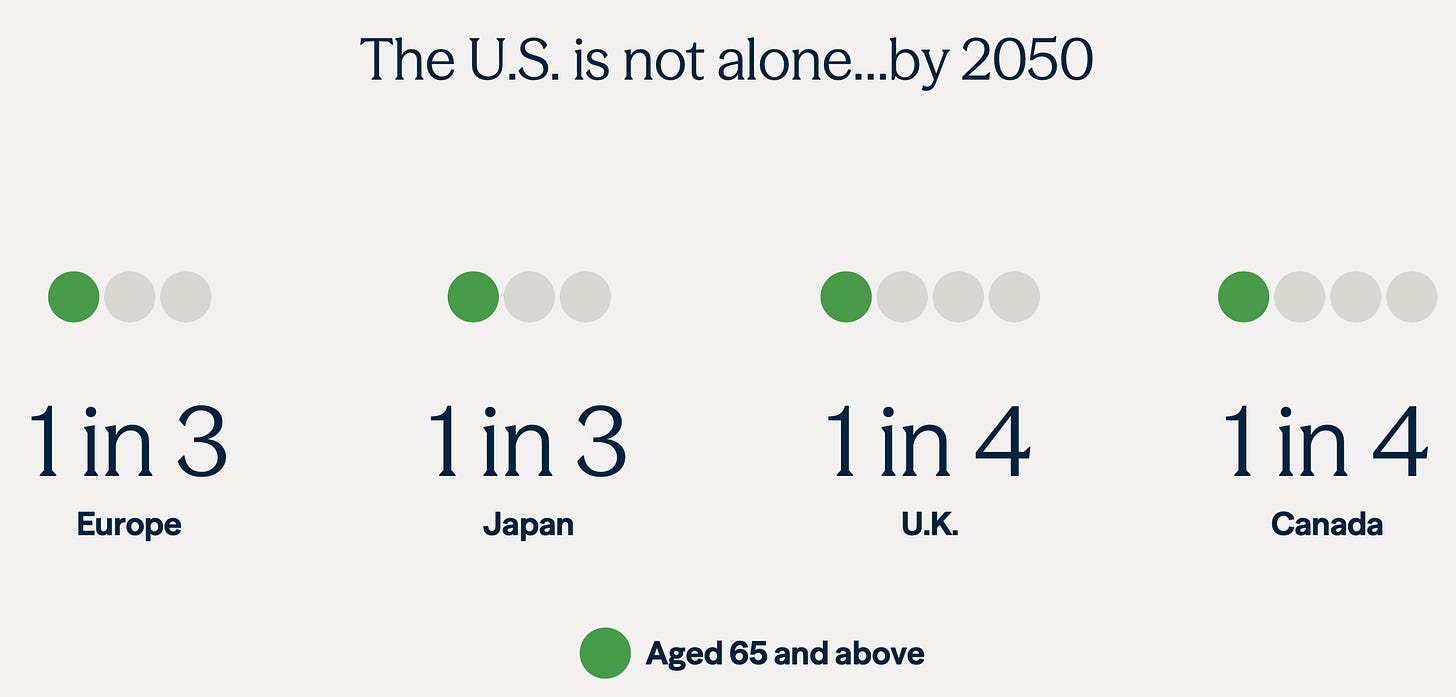

The premise starts with demographics: an aging population across the Western world, longer lifespans, shrinking birth rates, and the erosion of defined-benefit pension plans. A century ago, only one in twenty Americans were over 65; today, it’s one in six, and by 2050, it’s projected to be one in four.

This shift, combined with a $7 trillion U.S. retirement income gap, is driving enormous demand for reliable income products.

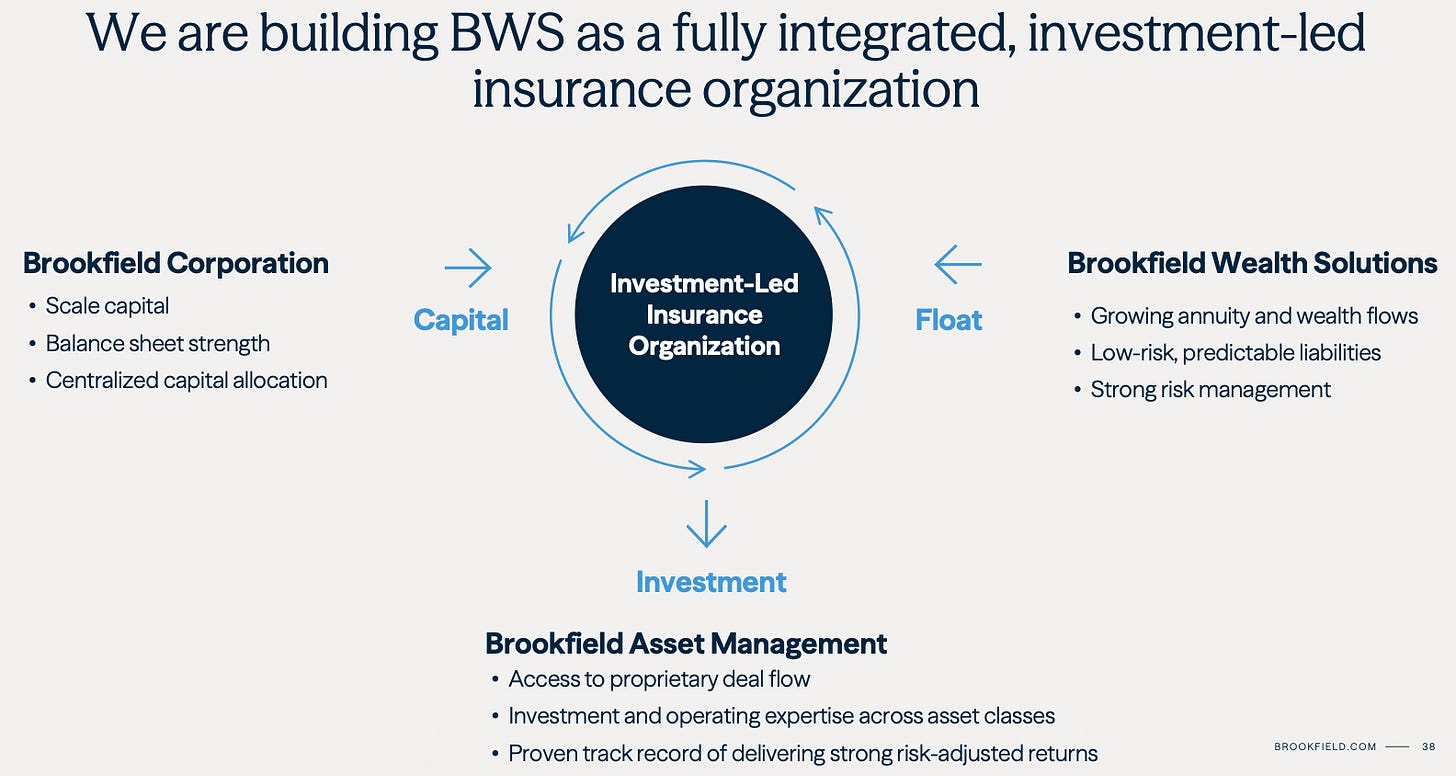

Brookfield saw this as both a societal challenge and a generational investment opportunity. The idea was to marry its decades-long expertise in managing long-duration, cash-generating real assets with the stable, predictable capital base that comes from insurance float (the policyholder capital it invests on behalf of clients). As Shah put it, Brookfield could “compound capital for many decades to come” by aligning its investment strengths with the liability needs of retirees seeking steady income.

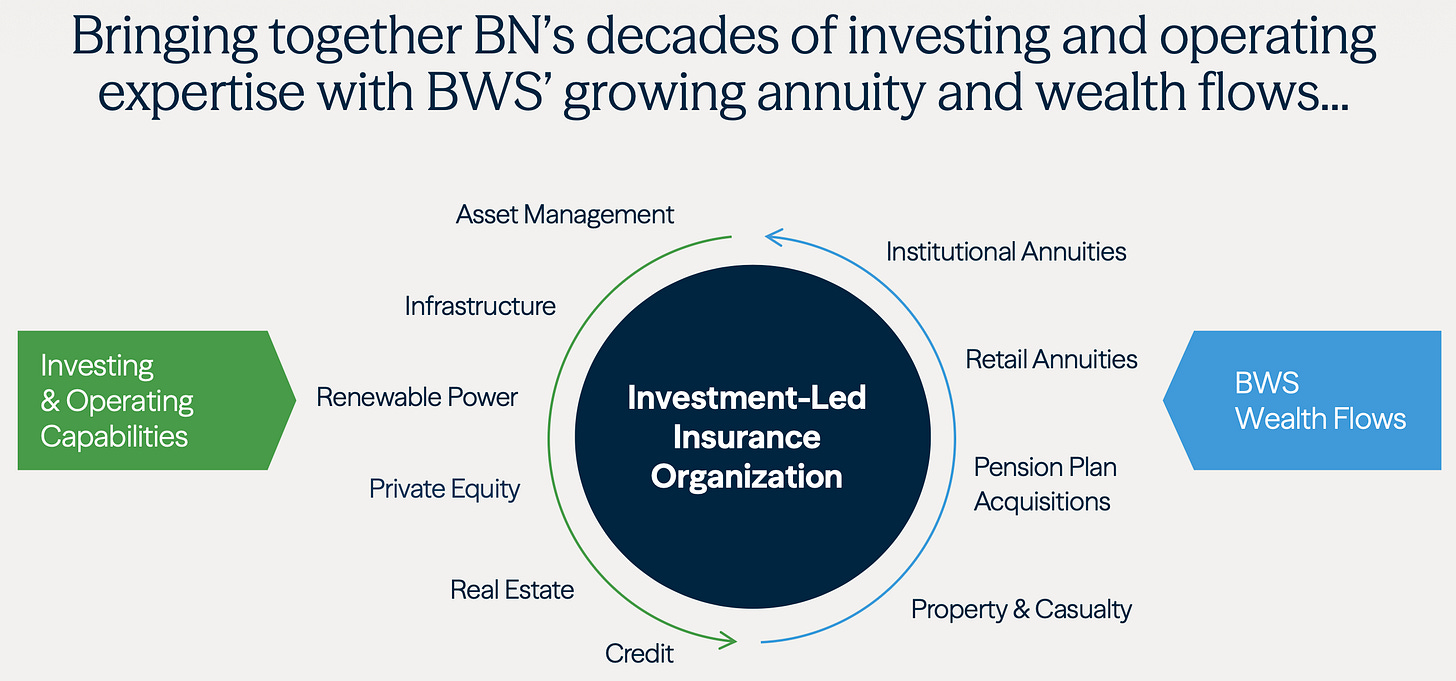

Initially focused on reinsurance, the strategy evolved toward a fully integrated insurance platform, owning its own distribution, writing its own policies, and directly matching long-term liabilities with high-quality, long-duration investments in infrastructure, power, real estate, and credit. This model not only fits Brookfield’s DNA but also complements its asset management arm (BAM), which earns fees for managing these assets on behalf of BWS, creating a symbiotic investment-led insurance flywheel.

In essence, Brookfield is using its investment expertise to turn insurance float into a high-return compounding engine. It’s a modern reinvention of the Berkshire Hathaway playbook, one that matches Brookfield’s global scale and long-term mindset. The philosophical shift from traditional to investment-led insurance is deliberate. As CEO Flatt explained:

“Traditional insurance underwrites insurance and tries to make money by underwriting insurance […] Investment-led insurance turns that upside down […] We seek float, we don’t seek scale […] Our model is designed to maximize capital efficiency […] and to earn 15% plus on the equity that we have in the business.”

Most insurers aim to profit from underwriting (pricing policies so that premiums exceed claims) while investing the resulting float conservatively to avoid losses. Brookfield flips that logic. It keeps underwriting low-risk and roughly breakeven because the real goal is to invest the float in long-duration, cash-generative assets it already knows well. BWS only grows when there are attractive investment opportunities for that float, maintains ample liquidity for safety and regulatory compliance, matches long-dated liabilities like annuities with long-term assets, operates with lower leverage, and targets 15%+ returns on the equity (ROE) supporting the business.

A simplified example illustrates the model. Suppose BWS writes $1 billion of annuities. To back those promises, it holds $1 billion in assets - say, $500 million in liquid high-quality bonds and $500 million in BAM-managed real assets. If the bonds earn 5% and the real asset sleeve earns 12%, the blended portfolio return is 8.5%. Credit customers receive 5% on their annuities; insurance operations cost 0.5%, leaving a 3.0% spread, about $30 million a year. Regulators require roughly $150 million of Brookfield’s own equity to support that $1 billion block, so $30 million of annual profit on $150 million of equity implies 20% ROE. A modest spread on a large float base can translate into high returns on the smaller slice of Brookfield’s own capital at risk.

BWS is exactly the synergistic counterpart Brookfield envisioned when it spun out BAM. In Flatt’s framing, the goal isn’t scale for its own sake, but durable float that can be invested through BAM. BWS sources patient, low-risk liabilities; BAM converts them into long-duration, cash-generative assets. That closed loop is the flywheel.

BWS has already scaled from zero to $1.7 billion of DEs in five years, and now manages $135 billion in insurance assets (total balance sheet capital held across its insurance and reinsurance subsidiaries). Management expects it to contribute over one-third of Brookfield’s per-share profit growth in the coming five years and potentially generate more than $5 billion in annual DEs by 2030 - more than the entire company produces today.

Crucially, BWS has been built with regulatory rigor and balance sheet prudence. It operates with excess capital, low leverage, transparent disclosure, and strong regulator relationships, what Shah calls “a moat around the business”. With platforms now spanning the U.S., Canada, the U.K., and a developing foothold in Japan, Brookfield’s insurance footprint has become truly global. Following its recent U.K. acquisition, BWS now oversees $180 billion of insurance float and expects $20-25 billion of net inflows each year. BWS is well positioned to benefit from the global demand for retirement income solutions.

BAM: The Compounding Core (Fees + Carry)

Brookfield Asset Management (BAM) remains the engine at the center of the ecosystem. The business unit continues to grow its fee-bearing capital base and expects 20% annual earnings growth through 2030. By that year, DEs are projected to reach $7.7 billion, driven by both recurring management fees and realized carried interest. Goodman underscored that carried interest is entering a new phase:

“Over the next 10 years, we expect the net realized carried interest […] to be $25 billion. It was just $4 billion for the last 10 years […] We believe that our carried interest is now very much at an inflection point.”

Despite this, the market seems to underestimate the value of carried interest, a recurring theme across alternative asset managers. Brookfield’s historical ability to exceed its own five-year projections, however, lends credibility to its forward outlook.

BAM targets 20% annual earnings growth through the plan period, driven by fee-related earnings, carry realization, and scaled multi-strategy fundraising.

5-Year Track Record, Strong Numbers

Goodman’s summary of the last five years was straightforward: “we have delivered earnings growth of 22% […] and planned value growth of 16% on an annualized basis”, exceeding the 2020 Investor Day targets the company set for itself. He added that the “growth profile of the outlook […] is very strong,” underpinned by a conservative balance sheet and ample liquidity.

Across the business, capital formation and recycling accelerated: Brookfield “raised over $95 billion of capital […] deployed $135 billion […] monetized over $75 billion of assets” over the last 12 months, a step-change from prior years. Plan value rose to $102 per share (pre-stock split) with a 22% increase in the past year alone; proof, in Goodman’s words, of “$28 billion of value added in just 12 months”. Brookfield also returned “over $1.5 billion” to shareholders (dividends plus opportunistic buybacks), emphasizing that repurchases at discounts “added value to each remaining share”.

Asset Management (BAM)’s fee-related earnings grew 18%, supported by broad-based fundraising where “75% of [capital came] from complementary strategies” reflecting the platform’s diversification.

Wealth Solutions (BWS)’s DEs reached $1.7 billion while “maintain[ing] returns on equity in line with our long-term targets of 15%+”.

In the operating businesses unit, renewables and infrastructure grew Funds From Operations (FFO, akin to operating cash flow) by 13%; Real Estate “monetized $5 billion” from the balance sheet; Essential services & cash-flowing private equity businesses lifted EBITDA 15%.

Targets beaten, base strengthened - Goodman reminded investors that the 2020 plan to reach $4.8 billion DE before realizations and $100 plan value per share by 2025 was surpassed:

“We grew by 22% […] to $5.3 billion […] and increased our plan value to $102 per share.”

Over the same 5-year period, the stock price followed suit with a 17% total compound annual return on plan value and with 19% over 30+ years.

Price-Value Gap and the 5-Year Path

Goodman reiterated that Brookfield’s valuation approach “remains unchanged”: sector-appropriate methods summed the parts to $161 billion of plan value ($102/share pre-stock split) net of debt and preferreds. Despite the past year’s rally, he called today’s level “a very, very attractive entry point”: on Brookfield’s projected 5-year DEs, the stock is trading today at 10x forward DE.

As of September 9, 2025, Brookfield’s share price was $66.2, a 35% discount to management’s plan value of $102/share. I came to a slightly lower valuation on February 18, 2025 in a previous article based on Brookfield’s 2024 financial results and 5-year outlook at the time, as the financial results did not factor in the growth that the company has experienced in H1 2025.

Brookfield sees the stock price to intrinsic value gap closing through two engines: core growth (Asset Management, Wealth Solutions, operating businesses) and capital allocation (recycling, buybacks, strategic deployment). Management’s base case targets 25% annual DE/share growth over the next five years - 20% from the business units and 5% from capital allocation.

On that path, DE/share is modeled to reach $6.90 before realizations/capital allocation and $10.40 in total by 2030, while plan value compounds 16% from $102/share ($68/share post-split) to $210/share ($140/share post-split).

Why this outlook is credible: carried interest is at an “inflection point” (management expects $25 billion of net realized carry over the next decade; $6 billion within three years), free cash flow is projected at $53 billion over five years with $25 billion of optionality after dividends and organic reinvestment, and the balance sheet remains conservatively capitalized to support recycling through cycles. Add the strategic backdrop: rising allocations to alternatives from institutions and individuals, the scaling integration of BWS, AI infrastructure investment, and a real-estate recovery, and the investment case becomes compelling.

Brookfield has beaten its prior 5-year targets, and management aims to repeat that cadence with a disciplined allocation flywheel and increasingly visible carry. If Brookfield delivers $10.40 in DE/share (pre-stock split) by year-end 2030, the forward DE multiple on pre-stock split’s $102/price is 9.8x, a compelling setup reinforced by the current price-value gap. From today’s post-split price of $44/share to a projected post-split plan value of $140/share, the implied 5-year return is a 26% CAGR.

Final Thoughts

Brookfield combines the qualities I value most: owner-oriented leadership, a disciplined capital allocation framework, strategic adaptability, and a long runway of secular growth. It isn’t about short-term excitement; it’s a long-term compounding machine that keeps evolving, from traditional infrastructure to renewables and AI data centers, an investment-led insurance platform, and broader wealth solutions. Investor Day reaffirmed the vision and the execution discipline behind that evolution. The targets are ambitious, but so is the track record; few global platforms are as diversified, aligned, and forward-looking.

What stands out is Brookfield’s ability to add new, scalable profit pools without losing rigor, spinning out listed entities (2008), launching Wealth Solutions (2020), spinning off BAM (2023), and now building AI factories. As Bruce Flatt put it:

“Access to capital wins […] Innovation drives long-term returns […] Once we understand an industry, we move fast and deploy at scale”.

That mindset, paired with management’s deep alignment and multi-decade tailwinds in AI, wealth, and real estate, is why I continue to view Brookfield as a long-term compounder worthy of a top position in my portfolio.

For a deeper dive into each business unit, I recommend watching the info-packed Investor Day recordings on Brookfield’s YouTube channel.

Brookfield’s plan value is management’s sum-of-the-parts estimate of intrinsic value, valuing Asset Management, Wealth Solutions, and operating businesses using sector-appropriate methods, then subtracting corporate debt and preferred capital to arrive at total and per-share figures.