High Conviction, High Returns: Inside Bill Ackman's Pershing Square Holdings Portfolio

Two decades of lessons from Bill Ackman's focused, conviction-driven investment strategy

Bill Ackman has built a reputation as one of boldest institutional investors, running a concentrated, high-conviction fund at Pershing Square Capital Management since 2004. Over two decades, Pershing Square’s journey has featured spectacular highs and humbling lows, yet overall it has outpaced the broader market by a wide margin.

Ackman has never shied away from betting big – on companies, on turnarounds, and on himself – and Pershing Square’s track record highlights both the risk and rewards of conviction.

His approach blends deep fundamental research, activist engagement (these days more behind-the-scenes), and the patience to wait for the right price on great businesses. In this article, we dive into Ackman’s investment philosophy, review Pershing Square’s performance since inception, and highlight the theses behind all of his current bets.

Ackman’s Focused Philosophy and Track Record Since Inception

Ackman’s strategy centers on a focused portfolio of usually around 10 holdings. This concentration enables him and his team at Pershing Square to know each business inside-out and, when needed, use an activist playbook to unlock value. In the most recent Pershing Square’s Q1 2025 investor call, Ackman noted:

“[…] we’re not generally investor in markets. We’re an investor in a handful of specific companies and situations […]”

In practice, Pershing targets high-quality, simple and predictable companies, often with strong brands and market positions, where Ackman sees mispricing and can catalyze improvements through engagement. Early on, this activist approach led to notable wins, and some controversies: Pershing pushed Wendy’s to spin off Tim Hortons in 2006, took on Target in 2007-2008, engineered a turnaround at General Growth Properties after the financial crisis, and famously battled Carl Icahn unsuccessfully to short Herbalife in the 2010s. These campaigns earned Ackman a reputation as a “vocal corporate agitator”, though he recently pledged to adopt a “quieter, behind-the-scenes approach” to activism.

Performance – Outsized Gains and Brutal Setbacks

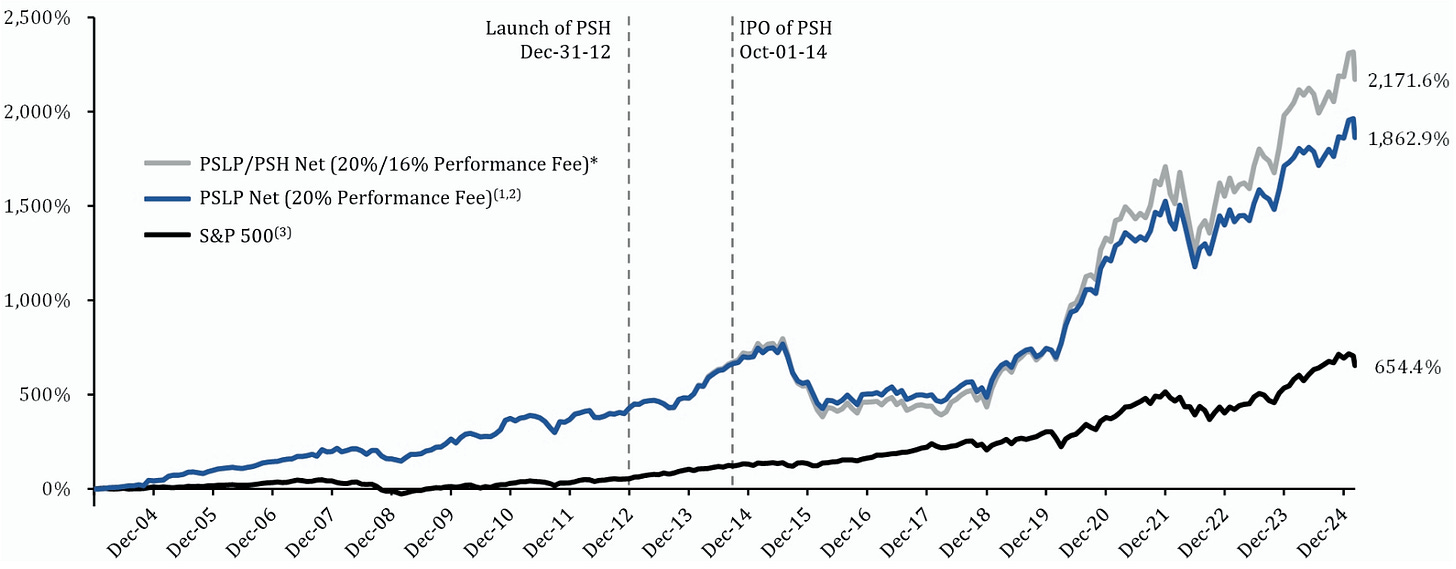

Since its 2004 launch, Pershing Square’s fund has delivered 15.9% annualized net returns, handily beating the S&P 500’s ~10% over the same period. To put this in perspective, a $1,000 investment with Ackman in 2004 would have grown to over $20,000 by December 31, 2024.

Ackman notched huge early gains, +42.6% in 2004 and +40.4% in 2014, and impressively shielded capital in 2008 with the fund being down just -13% vs. the S&P 500’s -37% in the financial crisis. But the mid-2010s brought humbling losses. In 2015 Pershing plunged -20.5%, its worst year ever after Ackman’s bet on Valeant Pharmaceuticals imploded. Further losses in 2016 (-13.5%) and 2017 left the fund lagging and many questioning Ackman’s aggressive tactics.

Ackman responded by rethinking his strategy and capital base. In 2018, Pershing entered its “permanent capital” era, relying on its publicly traded vehicle, Pershing Square Holdings (ticker symbol PSH traded on the London Stock Exchange), to avoid investor redemptions and refocusing on core principles of long-term, concentrated investing. The comeback was dramatic. Pershing roared back with a +58.1% gain in 2019, a stunning +70.2% in 2020, followed by +26.9% in 2021. A savvy hedging move during the March 2020 COVID-19 crash when Ackman turned a $27 million credit protection bet into $2.7 billion in profits, provided capital to deploy into beaten-down stocks, turbocharging those returns. By 2022, Ackman was again playing defense, hedging rising interest rates. Pershing fell -8.8% in 2022 amid the market downturn, but outperformed the S&P’s -18% slide that year. From 2018 through 2022, Pershing compounded at over 25% annually, a testament to Ackman’s reinvigorated approach.

The addition of permanent capital and a more understated activist style marks a key inflection in Pershing’s story, one that has allowed Ackman to pursue his convictions with less distraction. Today, according to their July 2025 fund’s fact sheet, at around $17.7 billion in assets under management (AUM), Pershing remains relatively small by mega-fund standards, which Ackman views as an advantage: it’s large enough to back big ideas but nimble enough to concentrate in his highest-conviction names without liquidity constraints.

Inside Pershing Square’s Portfolio: Holdings and Investment Theses

Pershing Square’s current portfolio reflects a mix of stable compounders and a few new bets that align with his long-term thinking strategy. As of Q2 disclosures, Pershing owns 15 companies. Many are household names, a departure from some earlier forays into lesser known companies, and each position embodies a clear strategic thesis. Let’s examine these holdings and why Ackman is invested in them.

Alphabet (Google) – “One of the world’s greatest businesses”

Pershing Square initiated its stake in Alphabet (GOOGL 0.00%↑) in March 2023 – Bill Ackman’s first major move after a quiet 2022. Pershing’s partner Bharath Alamanda summed it up on the Q1 2023 investor call:

“Google is a company we’ve studied and admired for a really long time. We think it’s one of the world’s great businesses with deep barriers to entry and incredibly strong network effects underpinning its core search franchise.”

The thesis rests on Search’s durability, YouTube’s dominance, and Google Cloud’s accelerating monetization, and long-term operating leverage as growth CapEx normalizes. Alphabet’s returns on invested capital (ROIC) in the mid-20s mark it as a high-quality, cash-generative business bought at an attractive price. By early 2023, Alphabet traded at “only 16x forward earnings” and “approximately 19 times forward earnings” – levels Pershing viewed as a deep discount to peers with similar projected growth. As they wrote in the 2023 Annual Report:

“We continue to believe Google is one of the most advantaged and scaled players in AI with an unmatched business model […] a deep discount to its peers despite its similar rate of projected earnings growth.”

Pershing saw AI fears as misplaced, noting Alphabet’s decade-long integration of AI into Search, Maps, Gmail, and YouTube. They expect low-teens revenue growth and expanding free cash flow margins, citing Google Cloud’s breakeven profitability milestone in 2023 as a sign of operating leverage.

For Ackman, Alphabet is the archetype: a wide-moat, cash-rich compounding machine bought in a moment of doubt, a bet that’s already doubled in value.

Amazon.com – A “fantastic franchise” at a 30% off sale

In May 2025, Pershing Square revealed a major stake in Amazon.com (AMZN 0.00%↑), a company they had admired for years but never owned until its stock fell over 30% from recent highs. Pershing’s CIO, Ryan Israel, called it:

“A fantastic franchise […] trading at about 24 and a half times earnings, which was the lowest multiple that we’ve seen ever since we followed the company in its history.”

AWS remains “the 800-pound gorilla” of cloud computing, throwing off high incremental margins as companies shift IT workloads to the cloud. Retail benefits from unmatched selection, a best-in-class logistics network, Prime’s loyalty ecosystem, and a fast-growing, high-margin advertising arm. Together, these scale advantages create a “virtuous cycle” that reinforces growth.

Pershing expects margin expansion under CEO Andy Jassy’s efficiency push and sees temporary AWS growth concerns as overblown. The position was funded in part by selling Canadian Pacific (CP 0.00%↑) “with regret”, to rotate into a faster-compounding opportunity at a compelling entry point.

Brookfield Corporation – “A high quality, asset rich, rapidly growing business”

Pershing Square began buying Brookfield Corporation (BN 0.00%↑) in Q2 2024, calling it “a leading alternative asset manager with high-quality and rapidly growing cash flows”. The entry came after a period of market volatility that left Brookfield’s valuation attractive relative to its growth profile and fee-generating asset base. They quickly built it into high-teens position of the stock portfolio.

The Canadian conglomerate sits atop a network of listed affiliates and, most importantly, owns 73% of Brookfield Asset Management (BAM 0.00%↑), “Brookfield’s crown jewel”, with $540 billion of fee-bearing capital across infrastructure, renewables, real estate, and credit – expected to “nearly double through 2028”.

Other value drivers included a preferred claim on carried interest projected to grow from $450 million to $2.5 billion annually, dividends from $18 billion of stakes in listed affiliates, an $11 billion investment in BAM’s funds, a $24 billion real estate portfolio, and a fast-growing Wealth & Retirement Solutions business managing $115 billion of insurance float. Pershing’s partner Charles Korn noted in the Q3 2024 investor call, “very strong parallels to Apollo and KKR” with earnings from this unit potentially rising from $1.3 billion to over $3 billion.

Despite this, Brookfield trades at ~15x Pershing’s earnings estimate, far below peers at 22-27x. Korn argues the market is “basically giving you $50 billion of value for free”.

Finally, Pershing’s respect for Brookfield stems from Ackman’s work with CEO Bruce Flatt during the General Growth Properties restructuring, which he called “one of the most satisfying and successful experiences I’ve had working with another management team”.

Chipotle Mexican Grill – “A fantastic investment because it’s been a fantastic business”

Pershing Square entered Chipotle Mexican Grill (CMG 0.00%↑) in September 2016 amid food safety crises and collapsing sentiment. They viewed the sell-off as an opportunity to own a brand with loyal customers and fixable problems. The turnaround, led by CEO Brian Niccol, brought a management overhaul, digital ordering, operational discipline, and an expansion from ~2,000 to over 3,400 stores.

By 2024, Chipotle was delivering mid to high-single-digit same-store sales growth, 25%+ restaurant margins, exceptional unit economics with new stores paying back in two years, and a clear runway toward a 6,000+ North American locations plus international growth.

After years of compounding and a premium valuation, Pershing trimmed the stake in Q1 2024, redeploying capital to Brookfield and Nike, but Chipotle still represented a high single-digit position in the portfolio. With new CEO Scott Boatwright at the helm, Pershing remains confident. For them, Chipotle is proof of their playbook: buy quality during temporary setbacks, hold through the compounding, and trim when valuations outrun fundamentals.

Fannie Mae & Freddie Mac – “A royalty in the U.S. housing finance system”

Pershing Square has long championed the value trapped in government-controlled mortgage giants Fannie Mae and Freddie Mac. As Bill Ackman framed it in the Feb 11, 2025 investor update:

“Fannie [and] Freddie are uniquely situated to be great forever assets for the U.S. government to own.”

The investment case rests on their dominant duopoly in U.S. residential mortgage guarantees, a business generating consistent, high-margin earnings. Together, they support $7.6 trillion of mortgage debt and produce double-digits return on equity (ROE). Pershing expects long-term EPS growth from steady volume expansion, modest pricing power, and tight cost controls.

The core issue, and opportunity, is their status in federal conservatorship since 2008. Pershing argues that recapitalization and release are inevitable as their capital buffers grow and the political consensus shifts. In Ackman’s recent presentation, he estimates “common shares will be worth a large multiple of today’s trading prices if this likely privatization path occurs”, with normalized earnings implying double-digits ROE in perpetuity.

Ackman’s confidence also reflects his belief in the institutional importance and operational quality of both enterprises, which have continued to modernize underwriting and risk management despite political limbo.

For Pershing, Fannie and Freddie are a classic deep-value, event-driven bet: irreplaceable franchises whose ultimate liberation from government control could yield outsized returns.

Hertz Global Holdings - “An asymmetric range of outcomes”

In April 2025, Bill Ackman revealed that Pershing Square built a position in Hertz Global Holdings (HTZ 0.00%↑) from Q4 2024, owning 19.8% of the company and betting on a turnaround story with option-like upside. Hertz today controls a 500,000-vehicle fleet valued at ~$12 billion, financed through ABS facilities. A 10% lift in used car prices, a likely outcome under new tariffs, would create ~$1.2 billion in gains, equal to half the company’s market cap. Critically, 70% of 2025 fleet purchases were locked in pre-tariff, insulating Hertz from cost inflation.

Ackman calls Hertz, “an operating company combined with a highly leveraged portfolio of automobiles”. After a costly Tesla misstep, CEO Gil West is rotating the fleet, cutting depreciation, and lifting revenue per unit. With utilization targeted to rise from 80% to 85% and management guiding to ~$1,500 revenue per unit and ~$300 depreciation per unit, Pershing estimates ~$2 billion of adjusted EBITDA by 2029. At today’s PE multiple of 7.5x, that implies ~$30/share.

Pershing sees additional levers: oligopolistic industry discipline (95% controlled by Enterprise, Avis, and Hertz), new AI inspection tech with up to $700 million in savings, and long-term upside from potential partnerships with Uber, where Hertz’s 11,200 locations and servicing expertise create a moat. With debt maturities pushed out to 2028-29 and ample liquidity, Pershing views Hertz as a deeply asymmetric bet, volatile in the short term, but with the potential to be “an in-the-money option” on industry normalization and structural change.

Hilton Worldwide Holdings – “A unique combination of predictability, resiliency and capital-light growth”

Pershing Square first invested in Hilton Worldwide Holdings (HLT 0.00%↑) in October 2018, attracted to its “high-quality, asset-light business with a long runway for earnings growth”, where hotel owners bear the capital costs and Hilton collects recurring, high-margin fees. This structure drives strong earnings, high returns on invested capital, and minimal capital requirements.

By 2024, Hilton’s system had grown to over 8,400 hotels and 1.27 million rooms across 126 countries, with a robust pipeline of more than 460,000 rooms underscoring Hilton’s growth runway. Fee-based revenue scales with room count and revenue per available room (RevPAR), boosted by substantial capital return program (share buybacks), allowing earnings per share (EPS) to grow faster than the underlying industry.

Hilton also boasts a powerful loyalty engine: Hilton Honors’ 180 million members drive repeat stays and strengthen relationships with hotel owners, creating a formidable competitive moat. Management, led by CEO Chris Nassetta since 2007, earned Pershing’s praise “for whom words do not do justice” for disciplined capital allocation, and a focus on long-term brand value.

Valuation discipline remains central – Pershing trimmed its Hilton position from Q4 2023 after substantial gains but remains invested, viewing the company as a steady compounder with notable growth potential.

Howard Hughes Holdings - “A diversified holding company”

Pershing Square has long argued that the market mispriced Howard Hughes Holding (HHH 0.00%↑) as a rate-sensitive real estate developer. In 2024, Bill Ackman moved to fix that, converting Howard Hughes Holdings (HHH) into a diversified, publicly-traded holding company modeled on Berkshire-style capital allocation. As Ackman put it: “Post transaction, Howard Hughes becomes a diversified holding company that pursues the acquisition of controlling interest in private and public companies” with Pershing’s Ackman, Ryan Israel, and Ben Hakim running it – notably without salaries, stock, or incentive fees.

The structure is simple: HHC, led by CEO David O’Reilly, remains the core operating subsidiary, compounding cash flow from its master-planned communities (MPC) and condo developments. Those fundamentals remain strong: $250 million in recurring operating-asset NOI on track to exceed $350 million, nearly $3 billion in contracted condo revenue at 25-30% margins, and land sales in new communities like Teravalis beating expectations.

Ackman envisions building an insurance franchise within HHH, modeled on the playbooks of Berkshire Hathaway, where recurring insurance float can be redeployed into long-duration, compounding assets. Unlike Pershing Square Holdings’ (PSH.L) concentrated public-equity strategy focused on large-cap businesses, HHH is designed as a permanent capital vehicle to wholly own companies.

Meanwhile, the drag from the New York Seaport was carved out into Seaport Entertainment Group (SEG 0.00%↑), with MGM veteran Anton Nicodemus hired to lead a planned spin-off. The move sharpens HHH’s focus on higher-return development while creating a separate growth path for entertainment assets.

Ackman sees the holdco transition as the catalyst for a rerating. Pershing believes HHH is “very inexpensive on a standalone basis”. With Pershing committing $900 million at a premium to market for a 48% stake, the bet is clear: use the holding structure to compound beyond real estate, recycle cash into new businesses, and close a valuation gap Ackman argues leaves billions on the table.

Nike – “One of the world’s most valuable and iconic brands”

Pershing Square held Nike (NKE 0.00%↑) for “a brief and very profitable period late 2017 into early 2018”. At the time Nike was as a quick, high-return turnaround play that rallied faster than expected, prompting them to sell and redeploy into other opportunities. In Q2 2024, they started building a position in Nike, attracted by what Pershing’s analyst Anthony Massaro called “one of the world’s most valuable and iconic brands” trading at a discount during a “rare multiyear period of business and stock price underperformance due to poor strategic choices by the prior CEO”.

Pershing argues the operational missteps including over-indexing to Direct-to-Consumer (DTC) at the expense of wholesale, shifting from sport categories to gender silos, and overproducing lifestyle franchises are being unwound, but “the turnaround that the new CEO is engineering at Nike is resulting in tougher near-term financial results”. Medium-term, they expect a reversion to Nike’s long run trajectory, “high-single-digit revenue growth and margins that are more than double current levels” under the new CEO’s leadership as Nike is repositioning itself to be more full-price and sports-focused.

A key part of the bull case is leadership. Pershing’s view is unambiguous: Elliott Hill, a veteran at the company who previously ran global P&Ls as President, Consumer & Marketplace, “is the ideal person to reinvigorate culture and morale, unleash product innovation centered on sports, return to powerful brand-focused marketing, and rebuild wholesale relationships and distribution”, a plan Pershing believes will restore Nike’s earnings power.

After building the Nike position at an average cost of $90 a share, Pershing restructured its exposure – in early 2025 they converted their common stock position into deep in-the-money call options to preserve upside, unlock capital, and secure a low break-even with “option payoffs […] ~2x higher than the return from owning common stock” in a successful turnaround.

For Ackman’s team, Nike fits the Pershing formula: a wide-moat consumer franchise, bought during a temporary stumble, with the leadership and brand power to deliver years of profitable growth.

Restaurant Brands International – “A royalty on the future growth of fast food consumption all around the world”

Pershing Square has been a long-term owner of Restaurant Brands International (QSR 0.00%↑), viewing it as a unique platform of enduring quick-service restaurant brands – Burger King, Tim Hortons, Popeyes, and Firehouse Subs – each with strong customer loyalty and substantial global expansion potential. They highlight RBI’s asset-light franchise model, which produces high-margin, recurring royalty streams while requiring minimal capital investment from the parent company.

Recent performance shows accelerating same-store sales growth and robust unit expansion, with over 32,000 restaurants worldwide and ambitions for thousands more, particularly for Burger King and Popeyes, as well as ongoing menu innovation and digital engagement to drive traffic. The franchise model generates high returns on invested capital and abundant free cash flow, much of which is returned to shareholders through dividends and share buybacks.

RBI trades at a valuation Pershing views as attractive for a business with durable brands, a scalable operating model, and decades of growth ahead. Pershing’s analyst Feroz Qayyum commented in the Q1 2025 investor call:

“[…] the shares […] still trade at almost a 30% discount to other franchise restaurants like McDonald's, Yum! and Domino’s, all of which actually have very similar 8% operating profit growth algorithm. So we think that leaves ample room for Restaurant Brands to continue to outperform as it hopefully closes that gap over time.”

For Pershing, RBI is a long-duration cash compounder where scale, brand power, and disciplined franchising combine to produce resilient earnings in virtually any economic environment.

Uber Technologies – “A royalty on delivery and mobility”

Pershing Square began building its Uber Technologies (UBER 0.00%↑) stake in early 2025, revealing by February that it had quickly become one of the fund’s largest holdings, worth over $2.3 billion. Pershing’s CIO Ryan Israel called it “the world’s leading rideshare and delivery marketplace”, with a business model that has shifted from cash-burning startup to capital-light, high-margin platform.

By 2024, Uber had generated $6.9 billion in free cash flow, with management guiding to substantial growth ahead. Israel emphasized the embedded operating leverage: incremental gross bookings require minimal extra capital, enabling margins to scale rapidly.

Uber’s moat is its global network of “170 million customers, 8 million drivers, in over 70 countries”, where demand and supply reinforce each other in a “positive virtuous cycle” of lower wait times, higher driver earnings, and reduced user prices. Israel also highlighted Uber for Business as “the fastest growing product across the company at over a 50% growth rate”.

Pershing also sees autonomous vehicles (AV) as a catalyst, not a threat – “it’s irrational for people to try to rebuild Uber’s network rather than partner with them”, noting 14 AV partnerships, including Waymo. With AV adoption “many, many years out”, Uber has time to entrench its dominance and capture gains as per-mile costs drop.

Valuation was key: Israel highlighted that “a business trading for only 29x earnings in light of 30% going forward annual EPS growth […] is very cheap”. On leadership, Israel praised CEO Dara Khosrowshahi:

“He is excellent. He’s been there for nearly eight years, took over from the founder and has really instilled an operational and capital allocation discipline that was lacking under the prior management team.”

For Ackman, Uber is the kind of scalable, asset-light compounding machine he loves, one that earns a “royalty on delivery and mobility” and still trades at a multiple Pershing views as low for its growth trajectory.

Universal Music Group – “A royalty on greater music consumption”

Pershing Square views Universal Music Group (UMG.AS) as one of the world’s most advantaged businesses – “a royalty on greater global consumption and monetization of music” with an irreplaceable catalog, unrivaled scale, and durable, recurring revenues.

Their thesis rests on the industry’s transition from physical and download sales to streaming, which provides UMG with a recurring revenue model that compounds with subscriber growth and pricing power. UMG earns royalties regardless of which streaming platform wins, making it a low-risk way to benefit from this secular tailwind. The company also benefits from publishing rights, merchandising, and brand partnerships, creating multiple layers of monetization on top of its deep artist roster.

At its September 2024 Capital Markets Day, UMG set mid-term targets of 7%+ revenue growth, underpinned by 8-10% subscription gains and double-digit profit growth, goals Pershing views as conservative given past outperformance. Already, new licensing deals with Spotify and Amazon incorporate higher wholesale rates and price increases, validating the model. As Pershing’s CIO Ryan Israel noted in the Q1 2025 investor call, “the low price point and the recurring nature of music subscriptions insulate it from the vicissitudes of the economy”.

Pershing sees two catalysts for rerating the stock: a planned U.S. listing, which would broaden the investor base and potentially lead to index inclusion, and the appointment of a new CFO to sharpen shareholder communications.

Collectively, these holdings show a Pershing Square portfolio tilted towards dominant, cash-generative businesses – from tech titans to consumer brands – all purchased with a margin of safety. Ackman’s recent moves into large-cap tech (Alphabet, Amazon, Uber) are especially noteworthy; they mark an evolution from his earlier focus on more “special situation” investments toward embracing some of the world’s largest businesses when he perceives them to be temporarily mispriced. In each case, Pershing Square has articulated a clear investment thesis: buying great companies when short-term sentiment or complexity has created an attractive entry point.

Conclusion: Ackman’s Evolution into a Long-Term Compounder

Bill Ackman’s two-decade journey with Pershing Square is a study in evolution. The outspoken activist once known for high-profile battles and a bruising Valeant loss has recalibrated into a quieter, more disciplined allocator of capital. What endures is his willingness to run a concentrated portfolio, where each position reflects in-depth research and the conviction to hold through volatility.

The portfolio today underscores this shift. While asymmetric plays like Hertz or Fannie Mae remain, Pershing’s core bets now center on global franchises with durable moats, recurring revenues and years of compounding ahead – Alphabet, Amazon, Brookfield, and Universal Music Group.

The structural turning point was Ackman’s embrace of permanent capital in 2018. By eliminating redemption pressures, Pershing could weather drawdowns, hedge opportunistically, and seize crises as opportunities – most famously with its $2.7 billion windfall in March 2020. Today, Ackman’s setup resembles a family office with institutional scale: patient, flexible, and designed to compound wealth over decades.

For level-headed investors who want to hear Ackman in his own words, episode #413 of the Lex Fridman Podcast, offers a candid window into his thinking.