Evolution AB's Q3 2025: When Short-Term Problems Become Structural

How Q3 (and Q2) results force a rethink of my investment thesis, and what must change for Evolution to re-earn a growth multiple

Back in early May 2025, I argued that Evolution AB’s (EVO.ST) underwhelming Q1 2025 numbers looked largely self-inflicted: ring-fencing in Europe and heavy-handed cybersecurity measures in Asia were depressing the top line, but those moves would, in time, fortify the franchise. I kept my position, expecting a re-acceleration as capacity ramped and compliance friction eased. Two quarters later, the Q3 2025 results (presentation, press release) presented on October 23, 2025 make that stance harder to defend. The short-term problems increasingly resemble a new operating baseline rather than a transient blip.

What Q3 Results Said

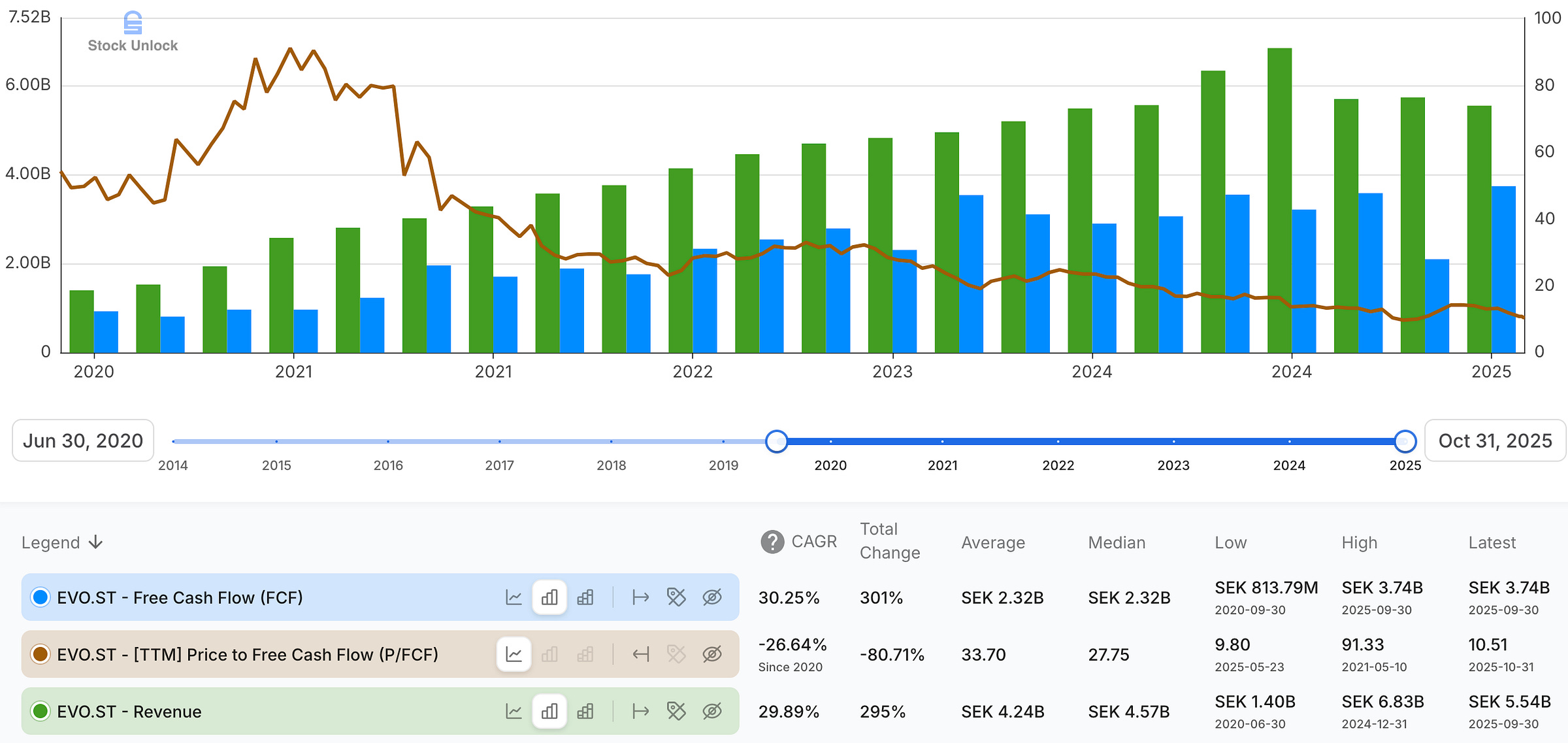

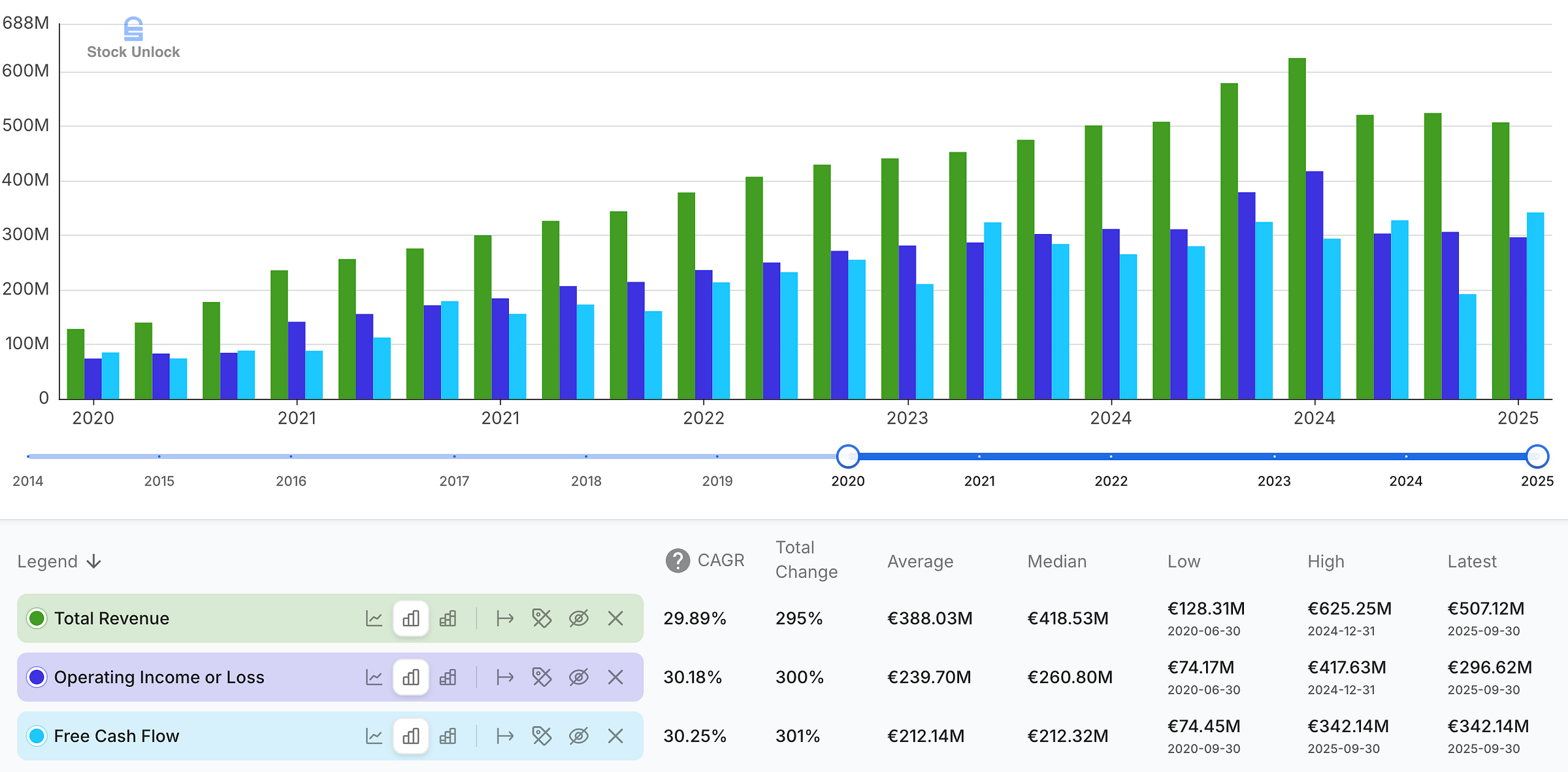

Revenue fell 2.4% YoY to €507.1 million - Evolution’s first YoY decline and the 12th sequential quarter of growth deceleration.

Live Casino revenue (85% of mix) contracted 3.4% YoY; RNG grew 4.1% YoY (15% of revenue).

During the Q3 earnings call, CEO Martin Carlesund, commented on the revenue decline, saying:

“[…] overall revenue is not where I want it to be. […] The development in Europe, North America and Latin America is overall good and also supports the margin […]”

Regionally, Asia broke. Revenue slid to €189 million (-6.5% YoY, -9.6% QoQ) as counter-piracy measures overshot and hurt legitimate users. Management’s tone shifted from cautious optimism to acknowledging they over-extended actions and still don’t have a time frame for normalisation. Europe finally ticked up sequentially after the full ring-fencing effect, but remained -6.5% YoY at €182 million. North America grew +14.5% YoY to €74.2 million, Latin America +6.4% YoY to €39.8 million.

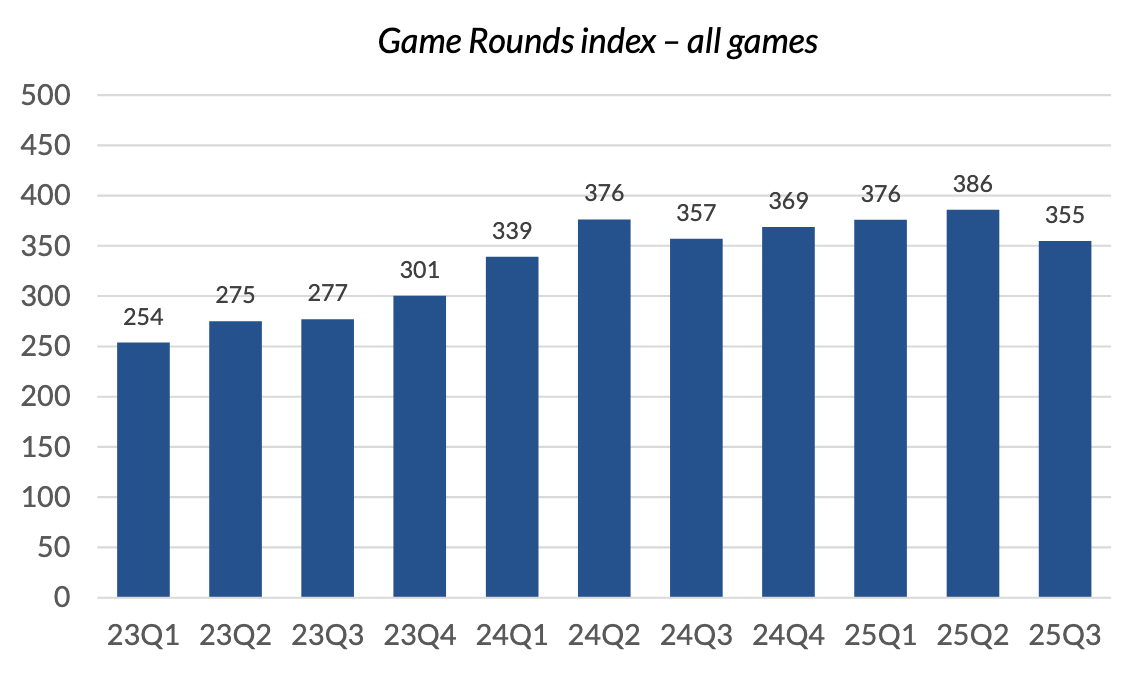

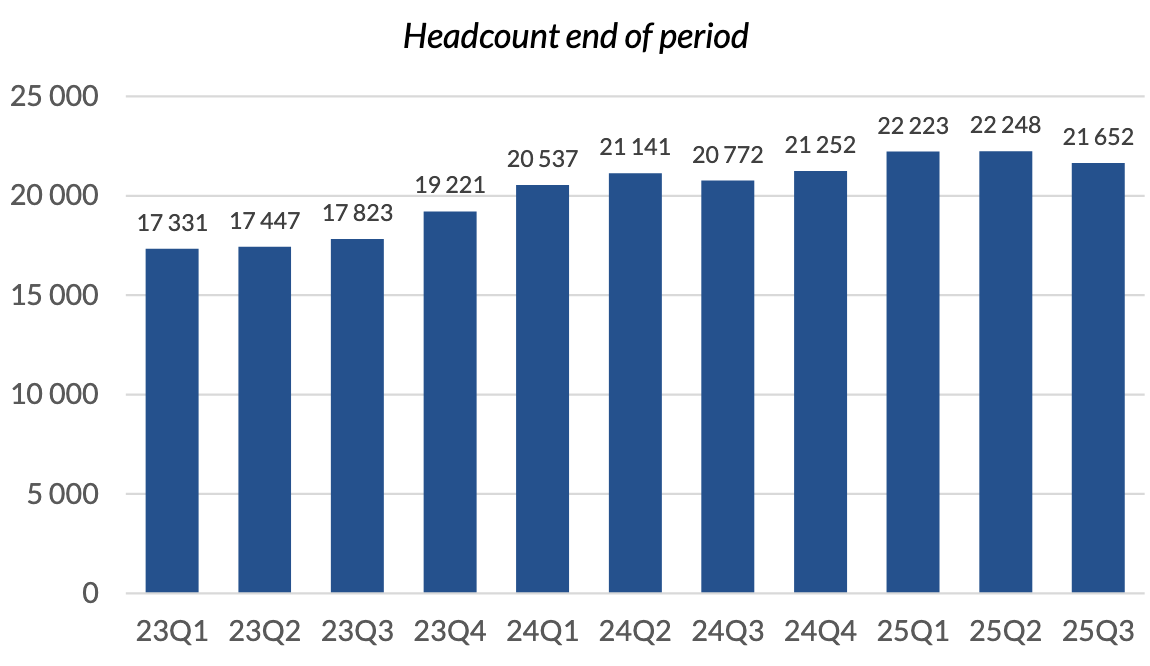

Operating leverage stalled. OpEx grew +5.3% YoY but fell -3.4% QoQ as the company pivoted to cost control. Headcount declined sequentially (21,652 vs. 22,248 in Q2) even as it was still +4.2% YoY; Game Rounds Index slipped -0.6% YoY and -8.03% QoQ.

Cash flow stayed strong. Q3 operating cash flow was €371.9 million; with €29.8 million of CapEx (intangible + tangible), free cash flow was €342.1 million (a modest 4.2% YoY growth) and cash conversion 83%.

Regulated mix keeps rising - 46% in Q3 vs. 45% in Q2. Consistent with the strategic pivot I highlighted in Q1, but it is not yet translating into growth.

Legal overhang twists the narrative. After a New Jersey court saga, Playtech was identified as the client behind the 2021 smear dossier (via Black Cube); Evolution will expand its defamation case; Playtech contests the allegation. This may prove financially immaterial but it underscores the intensity of competitive dynamics.

Where Q3 Hits My Q1 Thesis

Back in May I laid out a “friction now, re-acceleration later” case; Q3 tested each pillar of my investment thesis:

Europe’s ring-fencing would reset the base and allow sequential growth.

This part is playing out, Europe returned to +1.1% QoQ growth, but QoQ stabilization isn’t offsetting Asia’s damage.

Asia’s cyber issues were a solvable execution problem with long-term upside intact. Management now admits they over-did the countermeasures and still lack a resolution. After over a year of firefighting, this looks structural, not episodic.

Capacity additions: Studios in Brazil, the Philippines; dedicated North American environments would monetize in H2.

New sites are off to a good start, and North America/LatAm grew, but the Game Rounds Index declined and Live Casino revenue fell; capacity isn’t yet translating into system-wide activity.

Profitability resiliency would bridge the growth gap.

EBITDA margins are still within the 66-68% guided range, and cash generation is stable, but operating leverage has turned negative for three quarters, forcing a sharper cost/resource mix optimization focus.

Put simply: Q3 converts a “temporary slowdown” into a handicap: Asia’s drag appears persistent, not transitory, and the company is managing for stability rather than market share gains.

Is Asia’s Piracy Problem Fixable, or Just Manageable?

Management says they’re spending “whatever is required” , yet also admits they overshot and hurt legitimate users, suggesting a tuning problem rather than a solvable one-off fix. As Carlesund put it:

“Every day and around the clock, we do everything that we can to mitigate the issues. However, some measures do impact also the end users, and this is what makes it tricky. At the point in time, within the quarter, we did too much, causing loss in revenue. Towards the end of the quarter, we found a better balance, but it’s still volatile. And we do constant security updates to our core to increase protection. We will continue to adapt the changes that are working, and to fine-tune the methods that are working well and explore completely new actions as well.”

When asked whether more spending could accelerate a fix, he was blunt:

“If I could throw more money at the problem and I would get a quicker solution, I would do that. I don’t see that it’s a money issue. We invest and we put the topnotch resources in the world to do whatever we can.”

To me, that confirms a cat-and-mouse dynamic: not a budget constraint, but a structural reality that must be continually managed via trade-offs; tighten too much and you block real users; loosen and pirates slip through. Carlesund also offered no timeline:

“I can’t share any sort of time frame on that right now. I’m a bit more cautious with that.”

One important nuance: the defensive work could become an edge beyond Asia:

“The protection measures that we add to our core [are] valid for the whole core […] So one of the upsides in doing what we’re doing now with advanced technology and AI and everything is that it also protects our core in other markets and all over the world. So I would almost say that it becomes a competitive advantage where we increase the gap to competition. And eventually, we make it so hard to steal our products.”

If piracy in semi-regulated pockets is an enduring tax on growth, Evolution likely needs to rethink go-to-market in those markets, beyond brute-force technical countermeasures, while proving that its strengthened core really does widen the moat globally. I can’t yet see that in the numbers.

India’s 2025 Online Gaming Law

India has tightened the backdrop for Evolution’s B2B supply without banning all online gaming: Parliament passed the Promotion and Regulation of Online Gaming Act, 2025 in August. The Act prohibits “online money games” (real-money stakes). Carlesund noted on the Q3 call:

“There are also other markets, such as India, that show signs of moving towards regulation, which creates a higher level of uncertainty than before.”

Despite Carlesund comment, to me, this functions as a de-facto total ban on real-money online casino in region, impacting operators using Evolution’s B2B solutions to move money, and it implies a clear financial headwind for Evolution.

The Fixed-Cost Reality

Evolution’s model carries a large fixed-cost base, notably 24/7 human presenters. When activity (game rounds) softens or geographies are gated, revenue per Full Time Employee (FTE) falls and operating leverage turns against the company. Q3 shows sequential OpEx cuts and a sequential headcount decline, a conspicuous shift from “hire to grow” toward “defend margins while we troubleshoot demand”. That’s prudent, but emblematic of a more volatile phase of the business.

Historically, Evolution only trimmed its workforce in 2020 (COVID studio measures) and 2024 (the Georgia strike), not due to weak demand. By contrast, Q3 marks the first deliberate, demand-driven downsizing, aligning with management’s own principle that “we don’t hire unless we grow”. Read plainly, this is a regime shift for a fixed-cost model: from scaling capacity on a rising tide to protecting margins amid low-to-negative growth expectations.

CapEx discipline is similar: with €29.8 million in Q3 and management signalling full-year CapEx “likely on the high side” versus the €140 million plan, the investment cadence is easing. This does not resemble the posture of a company seeing unconstrained demand and on the offensive to gain market share.

Bright Spots, And Why They’re Not Enough Yet

Europe’s base looks reset. After the painful cleanup, sequential growth suggests the ring-fencing phase is largely behind them. The UKGC licence review is still pending, but management reported no new developments in Q3.

North America & LatAm are working. Dedicated studios are going live across the U.S./Canada; Brazil is scaling ahead of plan. These regions can grow for years, but the mix is lower-margin than Asia, so earnings growth will lag revenue unless Asia stabilizes and returns to growth.

Cash remains a fortress. With €656.4 million in cash after €187 million of Q3 buybacks (YTD €406.5 million), Evolution can keep rewarding shareholders by continuing to buy back shares at low prices. The margin guide stayed intact.

Valuation Is No Longer The Whole Story

Q3 delivered €342.1 million of free cash flow. The balance sheet remains pristine and buybacks are material. However, the market is not merely discounting a few soft quarters; it is questioning the trajectory. The revenue decline, coupled with a more cautious CapEx cadence, and explicit cost discipline, signal business uncertainty rather than re-acceleration. Until Evolution demonstrates a credible path to normalizing Asia, re-accelerating growth, and restoring operating leverage, the stock price’s multiple will likely embed that uncertainty: Evolution stock now trades at 10.5x Price-to-Free-Cash-Flow (TTM), near its all-time low multiple.

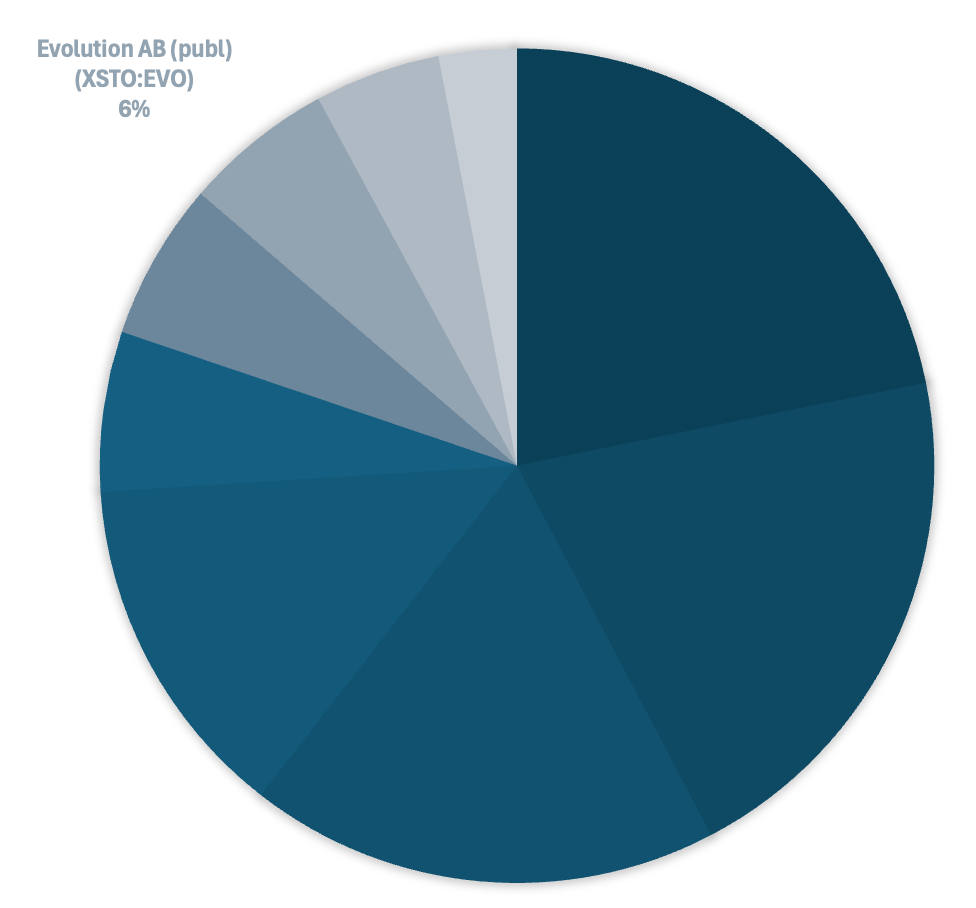

Revised Positioning: Hold With a Bias to Trim

I rated Evolution a hold in Q1 at an undemanding multiple, expecting improvement by late-2025. Post-Q3, I downgrade to hold/trim given the increasingly structural Asia risk, negative operating leverage, and a managerial pivot toward defense (cost control, tighter CapEx). My position has drifted from 10% (in late 2024) to 6% purely on stock price decline; I have not added since February 2025 and do not intend to buy the dip. I’ll keep Evolution as is and redeploy any trims into higher-conviction ideas, with new capital contingent on tangible progress against the following triggers:

Asia stabilization: Consecutive quarters of positive QoQ revenue and Game Rounds Index growth without new countermeasure shocks.

Europe momentum post ring-fencing: Continued sequential growth with regulated-mix gains not cannibalizing the top line.

Operating leverage: Revenue/FTE and free cash flow margin trending up alongside activity, not just via OpEx cuts.

North America monetization: Sustained double-digit growth with clearer throughput from new dedicated studios and meaningful contribution from Galaxy Gaming acquisition.

CapEx cadence: A re-acceleration from today’s cautious posture, signaling demand visibility.

Regulatory overhangs: Satisfactory conclusion of the UKGC license review and no new ring-fencing waves.

Final Thoughts

After Q3 2025, the “temporary slowdown then re-acceleration” view no longer holds; confidence now depends on demonstrated improvement.

The business is intact: market leadership, fortress cash generation, and enviable margins, but the profit engine (Asia) is impaired by an adversary that money alone cannot solve. Management’s own words now emphasize volatility, caution, and cost discipline rather than market share-taking growth. Europe’s base is reset and the Americas are progressing, yet the mix shift is lower-margin and operating leverage is negative. Until Evolution demonstrates Asia stabilization, renewed activity (game rounds), and the return of operating leverage, the multiple will likely remain anchored near trough levels despite stable free cash flow.