Amazon Catalysts in 2026 and Beyond

Commerce cost-to-serve deflation, re-accelerating AWS economics, and rising ad profitability

If you only look at Amazon.com (AMZN 0.00%↑) through the usual lens - near-term earnings and the annual CapEx number - you’d conclude the company is always investing and therefore perpetually hard to value. That framing misses what Amazon is building: an operating system for commerce and compute where upfront investment (robots, AI, data centers, custom chips) is designed to permanently reduce unit costs and expand the long-run profit pool.

Management is not subtle about the scale. In Q3 2025, Amazon reported capital expenditures (CapEx) of $34.2 billion, and $89.9 billion year-to-date (YTD), and explicitly expects these investments to rise further into 2026.

The payoff isn’t one AI product. It’s margin expansion across multiple lines: fulfillment and delivery cost-to-serve, advertising monetization, subscription retention, and AWS gross profit dollars. Over a long horizon, Amazon’s strongest pattern has been to build infrastructure once, then monetize it many times over.

Commerce Margin Through AI and Robotics

The cleanest long-term retail thesis for Amazon is not e-commerce growth. It’s cost per package down, speed up, and conversion up, enabled by automation.

In June 2025, Amazon’s warehouse robotics fleet surpassed one million units across 300 facilities, and the company has continued to push automation deeper into more complex tasks. In May 2025, Amazon unveiled Vulcan, a robot that combines sight and touch to handle items in human-like environments. Then in October 2025, Amazon introduced Blue Jay, which coordinates multiple robotic arms to pick, stow, and consolidate items in a single workstation, collapsing what previously required three separate robotic stations into one. On top of the physical robotics layer, Amazon is building an AI control plane for the network. DeepFleet coordinates and optimizes robot movements to reduce travel bottlenecks, improving robot efficiency and travel time by 10%. In addition, Amazon is layering in agentic AI for operators as well: Project Eluna is designed to cut through dozens of dashboards by using real-time and historical building data to anticipate bottlenecks and recommend actions to keep operations flowing smoothly.

Taken together with AI-powered inventory forecasting, reported to have improved regional forecast accuracy by 20%, these advances point to the same outcome: fewer wasted movements, faster throughput, and a structurally lower unit cost to fulfill and deliver packages. Importantly, Amazon’s fulfillment centers also make clear that the end-state is smarter human-robot collaboration. Robots handle repeatable or ergonomically difficult work (for example, Vulcan can pick from high and low shelves), while people stay focused on the edge cases, maintenance, and judgment calls.

Over the past year, Amazon’s management has consistently emphasized automation, robotics, and AI integration in fulfillment centers as the mechanism to improve speed, unit economics, and profitability. In the Q3 2025 earnings call, CFO Brian Olsavsky made that explicit, while also setting expectations that the path won’t be linear:

“Looking ahead, we see further opportunity to improve productivity in our global fulfillment and transportation network. We continue to improve inventory placement to drive down distance travel and touches for package. We will also build on the gains from our regionalized network through algorithmic improvements as well as launching robotics and automation. Operating margin may fluctuate quarter-to-quarter, we have a deliberate approach to achieve sustained progress over the long term.”

Warehouse automation drives four reinforcing advantages:

Faster inventory handling, which improves delivery promises and conversion.

Fewer touches per item, which reduces variable cost.

Better inventory placement decisions, which reduces distance traveled and split shipments.

Higher reliability, which increases customer trust and purchase frequency.

Amazon repeatedly points to improvements in operations and enhancements to customer self-service features, which it attributes to investments in AI systems and automation - reducing service contacts per unit and improving cost efficiency. That matters because cost-to-serve is not just pick/pack/ship; it’s also customer care, returns workflows, issue resolution, and the countless small frictions that scale with volume.

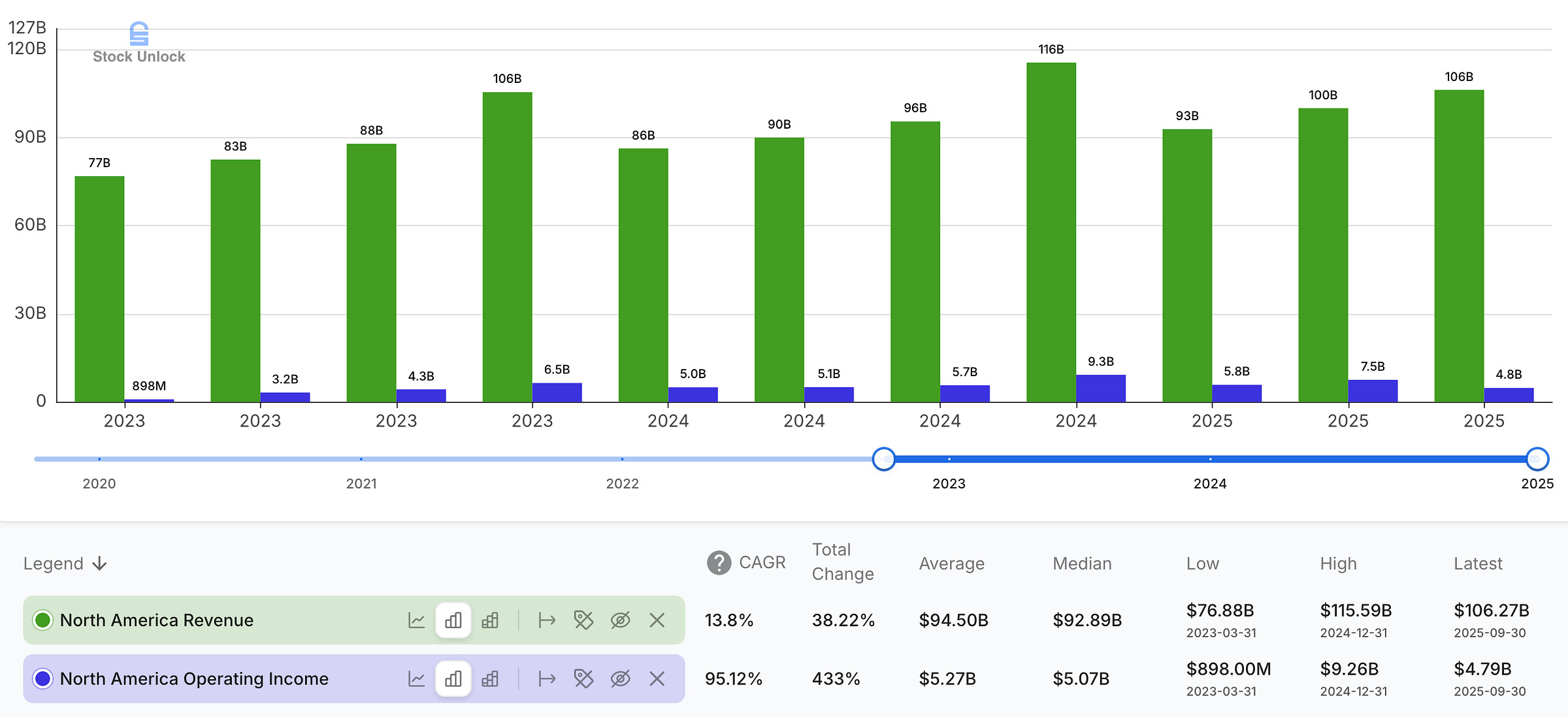

The impact shows up most clearly in the North America segment, where Amazon connects automation and AI initiatives directly to profit margin expansion. Newer robotic systems, combined with a more regionalized network and algorithmic optimization, have improved throughput efficiency and reduced per-unit handling costs, supporting operating leverage even as the company continues to invest.

The 2026+ catalyst is that the automation curve is still early. Once you cross a critical mass of robots and standardized AI control layers, improvements become increasingly software-driven: better routing, better task allocation, better forecasting, better exception handling. That’s the highest-quality kind of margin expansion because it tends to persist rather than reset each year.

A practical watch item for 2026: North America operating margin. It won’t rise in a straight line, but the underlying drivers are structurally moving in the right direction.

Grocery & Perishables: The “Trojan Horse” For Frequency and Higher Lifetime Value

Grocery has low standalone margins, so it’s easy to misread it as a dead-end category. The better way to view grocery is as an engagement lever: it increases purchase frequency and makes Prime stickier. That stickiness then supports higher-margin attach (ads, subscriptions, services).

Its recent push into same-day perishables is a concrete, near-term execution milestone that extends into 2026. In December 2025, Amazon announced same-day delivery for fresh groceries expanded from 1,000 to 2,300+ cities and towns, with further expansion coming in 2026. CEO of Worldwide Amazon Stores, Doug Herrington, framed it as customers combining grocery with regular Amazon purchases “in ways that make their lives easier and save them valuable time”.

Two details matter:

In same-day perishable markets, Amazon says “nine of the top ten best-selling items are now perishables”.

Amazon says “customers who add fresh groceries to their Same-Day Delivery orders shop about twice as often as those who don’t”.

Frequency is the hidden asset. If grocery increases order cadence, Amazon gets more opportunities to monetize intent (ads), increase basket size, and reduce delivery cost per item through denser routes and better inventory positioning.

This is strategically important because rural America is exactly where incumbents like Walmart are strong. Amazon is trying to close the convenience gap, using its own last-mile build-out plus AI-driven local demand prediction to stock the right items closer to customers.

In its Q3 2025 10-Q filing, Amazon described “investments in our fulfillment network, partially offset by fulfillment network efficiencies”, which suggests early returns from AI-driven logistics and route optimization efforts.

2026 watch items:

Expansion pace of perishables/same-day coverage.

Evidence that grocery attach increases Prime retention and order frequency.

Whether rural delivery improves unit economics (density, repeat purchase rates).

AWS’s 2026 Setup: Gigawatts + Trainium + AgentCore

The “AWS is slowing” narrative tends to appear when Microsoft Azure and Google Cloud Platform (GCP) post higher growth rates. The question I ask myself is simpler: will AWS keep capturing the AI workload wave profitably while maintaining strategic control over its cost base? AWS remains Amazon’s largest profit engine, and Q3 2025 was a good snapshot of why: revenue grew 20.2% year-over-year (YoY) to $33 billion while operating income increased 9% to $11.4 billion. CEO Andy Jassy framed the moment clearly:

“AWS is growing at a pace we haven’t seen since 2022, re-accelerating to 20.2% YoY. We continue to see strong demand in AI and core infrastructure […]”

From a 2026+ catalyst perspective, the core is capacity plus chips, with software increasingly acting as the multiplier. On the Q3 2025 earnings call, Jassy said AWS added 3.8 gigawatts of capacity in the last year, with “another gigawatt plus coming in the fourth quarter”, and expects to “double our overall capacity by the end of 2027”. The same discussion connects directly to custom silicon: AWS will keep buying NVIDIA and is “not constrained” in doing so; at the same time, it’s pushing hard on proprietary compute economics via Trainium (AI accelerators) and Graviton (CPUs).

What’s changed since earlier “AWS is falling behind in AI” narrative is that the custom silicon program now has tangible validation signals. Trainium2 adoption reportedly surged 150% quarter-over-quarter (QoQ) into a multi-billion-dollar business.

At re:Invent 2025 conference on early December 2025, AWS doubled down on the full-stack message - custom chips, foundation models, and distribution through AWS’s developer platform - highlighting Graviton5 and Trainium3 UltraServers alongside agentic infrastructure like Bedrock AgentCore, underscoring vertical integration as a core competitive advantage. Around the same time, SemiAnalysis published a deep dive positioning Trainium3 as a potentially serious challenger on cost/performance dynamics versus incumbent alternatives (NVIDIA’s GPUs and Google’s TPUs) - exactly the direction you’d expect if the AI market becomes more price-sensitive over time.

Jassy described Trainium2 as having “substantial traction, is a multi-billion-dollar revenue run rate business, has 1M+ chips in production, and 100K+ companies using it as the majority of Bedrock usage today”.

This fits with AWS’s strategy of anchoring custom silicon with large, demanding workloads: in addition to a million Trainium2 chips in production, Project Rainier connects more than 500,000 Trainium2 chips, built in collaboration with Anthropic to support Claude training and inference.

Jassy told investors Trainium3 volumes would be “much fuller” in early 2026 and linked adoption to cost-sensitive production inference workloads. In parallel, AWS is expanding its NVIDIA footprint with new Grace Blackwell instances, while continuing to broaden global infrastructure, adding major capacity, launching a region in New Zealand, and expanding its footprint with 10 additional Availability Zones.

This matters because it links directly to profitability. AWS operating margin improved, reaching 34.6% in Q3 2025 versus 30.3% two years prior, consistent with efficiency gains from proprietary silicon and scaling AI workloads.

At re:Invent 2025, AWS positioned Bedrock AgentCore as the production layer for agents. Jassy said it’s “worth double clicking”, emphasizing security and scalability, and highlighted new building blocks like Policy and Evaluations to control and measure agent behavior. He also argued “agents will become the primary way companies get value from AI”, pointing to AWS’s growing lineup (e.g. Kiro for coding) and to Nova Forge as a way to customize frontier models with proprietary data so companies can build differentiated agents, not generic wrappers.

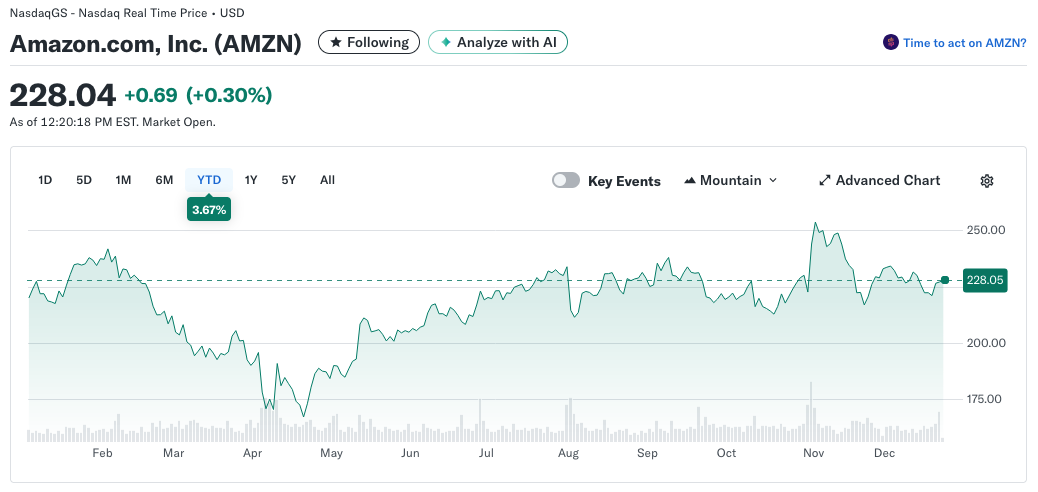

The strategic advantage is that if AI becomes a larger share of global compute, the long-run winners won’t just rent GPUs. They’ll win by offering multiple price-performance tiers, integrating hardware and software, and controlling supply and economics through design and procurement. If AWS nails capacity availability, delivers compelling price-performance across both NVIDIA and custom silicon, and pairs it with developer-friendly agentic tooling, then the “AWS AI resurgence” story becomes about measurable throughput; accelerating growth and durable operating income dollars. That combination could also remove skepticism about AWS’s AI competitiveness - a major overhang that has likely contributed to the stock being roughly flat in 2025 - and set up a 2026 upside surprise as new capacity comes online and more workloads shift onto differentiated, lower-cost compute.

One more important signal is organizational: Amazon is reshaping its AI leadership structure, with SVP Peter DeSantis overseeing an organization spanning AI models, custom silicon (Graviton/Trainium), and quantum efforts.

2026 watch items:

Capacity coming online fast enough to sustain >20% top line growth.

AWS operating margin - does it keep widening as AI scales?

Trainium3 adoption in real production inference.

AgentCore moving from tooling to scaled production usage.

Advertising + Prime Video Profit Pool: High-Margin Attach on Top of Commerce

Amazon’s retail engine throws off something more valuable than gross merchandise volume (GMV): intent. When customers arrive on Amazon, they often arrive to buy. Advertising is the monetization layer on top of that intent, and Amazon’s scale is now material enough that modest improvements in ad yield can translate into large incremental operating profit.

In Q3 2025, Amazon reported ad revenue of $17.7 billion with growth accelerating to 24% YoY for the third consecutive quarter. Over 2025, management repeatedly framed the ad business as a high-margin layer synchronized with the retail ecosystem, built on engagement, attention, and data synergies across commerce and media.

Prime Video is part of the same ecosystem logic: it supports Prime value perception and creates more surfaces for monetization (subscriptions, advertising, and customer engagement). Jassy explicitly connected the dots, noting that video advertising is “already a very large amount of advertising revenue”, while “still relatively early stage”. By October 2025, Amazon broadened the advertising surface area well beyond its own storefront and video properties by expanding Amazon DSP’s reach through major third-party inventory and audio integrations, effectively turning DSP into a global distribution layer for Amazon’s ad demand. Jassy put it plainly:

“[…] providing advertisers using Amazon DSP with direct access to Netflix’s premium ad inventory. We announced integrations with Spotify and SiriusXM. With Spotify, we provide advertisers with direct programmatic access to a global audience of more than 400 million monthly ad-supported listeners. And with SiriusXM, brands can reach 160 million monthly digital listeners across services like Pandora and SoundCloud”

On the owned-media side, he also highlighted that Prime Video live sports is drawing strong advertiser demand, with upfront commitments for 2025 and 2026 exceeding internal expectations.

Looking into 2026 and beyond, the combination of a scaled and increasingly efficient advertising engine with a fast-growing Prime Video ad platform positions Amazon with another multi‑billion‑dollar profit pool atop its core commerce base. In plain English: grocery increases frequency, Prime Video expands attention and perceived Prime value, and Amazon’s full-funnel ads monetize the entire journey, from discovery to checkout.

2026 watch items:

Can ads sustain >20% growth as Prime Video/live sports scale.

Does DSP’s broader reach convert into higher yield and bigger ad budgets.

Option Value That Could Become Real Value Beyond 2025

A long-horizon Amazon thesis should explicitly include options; projects that are not necessary for the base case, but can matter a lot if they hit.

Amazon Nova: multimodal AI model family, introduced Nova Multimodal Embeddings and Web Grounding, expanding capabilities across text, image, and video search.

Amazon Leo (“Project Kuiper”): In Q3 2025 earnings release, Amazon said it expanded the number of satellites to more than 150 and referenced 1+ Gigabit per second test speeds with an enterprise-grade terminal.

Zoox: Amazon noted Zoox robotaxis are available to riders in Las Vegas and mentioned Washington, D.C. as the eighth testing location.

These projects highlight Amazon’s diversification beyond commerce and cloud and deepen its optionality in connectivity, mobility, and AI-enabled services; they won’t drive tomorrow earnings, but they are asymmetric bets where a successful scale-up into commercial platforms could deliver upside far beyond what today’s valuations reflect.

Key Risks to Respect

Risks matter because Amazon is scaling multiple capital-intensive bets at once. Based on the company’s disclosures and what management is emphasizing, here are the risks I’m watching into 2026:

Execution risk in AI infrastructure: if AWS mis-times capacity, can’t secure power, or fails to deliver Trainium3 in volume, growth could lag peers even if demand is strong.

Competitive intensity across retail, grocery, cloud, and ads is real and highlighted in Amazon’s own risk disclosures.

Margin volatility: depreciation from data center build-out can pressure AWS margins and GAAP profits near term.

Final Thoughts

The real Amazon debate is whether Amazon is entering a phase where automation and AI convert scale into structurally higher margins in commerce, while AWS re-accelerates on a foundation of capacity and custom silicon. The evidence trail is already visible: in commerce with 1 million robots deployed with an AI control layer to raise throughput and lower unit costs; same-day perishables and rural logistics expansion to increase frequency and Prime value into 2026. In AWS, it’s capacity expansion plus a blended compute stack - NVIDIA where it’s best, and proprietary silicon where cost-performance and supply control become strategic. Layered on top is another profit pool: advertising and Prime Video, where incremental yield can translate into outsized profit dollars because shopping intent and attention are already there.

This is why “Amazon spends too much” is usually the wrong critique. The question isn’t whether the CapEx number is big; it’s whether the returns show up in the scoreboard. In commerce, I’m watching for falling cost-to-serve reflected in a higher (not perfectly linear) North America operating margin, plus evidence that perishables and rural expansion increase frequency without degrading unit economics. In AWS, I’m watching for capacity availability translating into sustained growth and durable operating income dollars, along with increased adoption of Trainium/Graviton chips. In ads and Prime Video, I’m watching for sustained ad revenue growth and improving profitability driven by expanding inventory (especially live sports) and broader DSP reach.

If Amazon executes across those three lanes at the same time, the next years should look less like spending and more like a compounding step-up in earnings power and cash flow.

Superb analysis on the vertical integration play. The thing that really stands out is how Amazon's using automation to creat operating leverage at scale rather than just chasing top-line growth. Most people see the CapEx numbers and freak out, but the warehouse robotics hitting 1M units while simultaneously improving margins shows the investment thesis is actually playing out. I've seen similar patterns in manufacturing where the companies that invested heaviest in automation during downturns ended up with unbeatable unit economics coming out. The Trainium adoption curve will be facinating to watch.